A carbon tax aims to make individuals and firms pay the full social cost of carbon pollution. In theory, the tax will reduce pollution and encourage more environmentally friendly alternatives. However, critics argue a tax on carbon will increase costs for business and reduce levels of investment and economic growth.

The purpose of a carbon tax

The purpose of a carbon tax is to internalise this externality. What this means is that the final price of the good should include the external cost and not just the private cost. It is similar to the ‘polluter pays principle.‘ – which was incorporated into international law at the 1992 Rio Summit. It simply means those who cause environmental costs should be made to pay the full social cost of their actions.

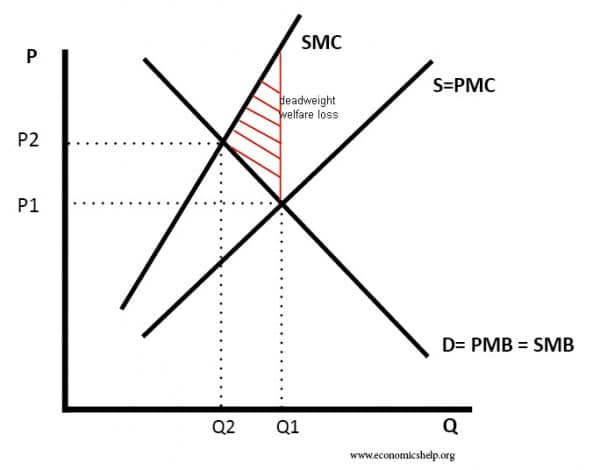

Diagram to show welfare loss of a negative externality

This diagram shows that in a free market (without any tax), we get overconsumption (Q1) of carbon, leading to a welfare loss to society.

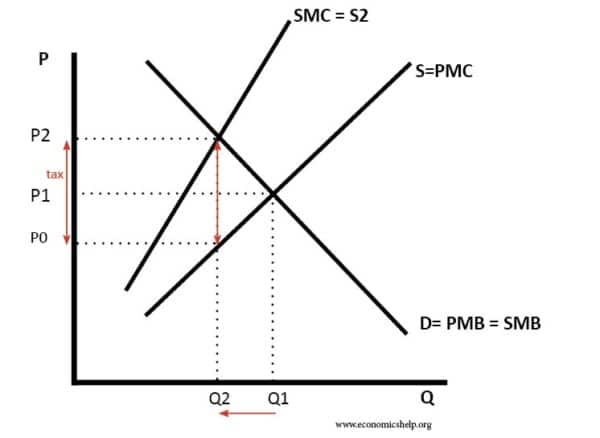

Social efficiency with Carbon Tax

The tax shifts the supply curve from S to S2. With the tax, consumers now face the full social cost (SMC). Quantity falls from Q1 to Q2. Q2 is socially efficient because social marginal cost = social marginal benefit.

Revenue neutral

In theory, a carbon tax should be revenue neutral. This means the tax raised from taxing carbon emissions can be used to reduce other taxes. There should be no overall increase in the tax burden. The aim is to increase social efficiency by making people aware of the full social cost.

Arguments for a Carbon Tax

1. Encourages alternatives. A higher price of carbon emissions will encourage firms and consumers to develop more efficient engines or alternatives to consuming carbon emissions. For example, with carbon taxes, it will be more efficient to develop hydrogen engines or solar power.

- It might encourage more people to cycle or walk to work. This would have health benefits such as lower risk of heart attack.

- This could make it more feasible to generate electricity from green sources (e.g. solar power). If we develop more green sources it will also make us less reliant on oil.

- It will help make the transition to a post-oil economy easier.

2. Raises revenue. The revenue raised from a carbon tax could be used to subsidise alternatives such as green electricity or the revenue raised could be used to repair the damage caused by environmental pollution. Alternatively, a higher carbon tax could be used to reduce other taxes, such as VAT.

3. Leads to a socially efficient outcome. It makes people pay the social cost and overcomes the excess consumption we see in a free market.

4. Improves the environment. WIth higher taxes, firms will reduce pollution and look for alternatives which have a lower environmental impact. For example, it will make solar power even more competitive than traditional fossil fuels.

Problems of a Carbon Tax

- Production may shift to countries with no or lower carbon taxes. (so-called ‘pollution havens’) This can give developing countries an incentive to encourage production processes which cause pollution, i.e. there is ‘outsourcing’ of pollution.

- The cost of administrating the tax may be quite expensive reducing its efficiency.

- It is difficult to evaluate the level of external cost and how much the tax should be.

- Possibility of tax evasion. Higher taxes may encourage firms to hide carbon emissions.

- If demand is price inelastic, the tax may have to be very high to reduce demand significantly. In the short term, firms may not feel they have many alternatives. Though, over time, demand will become more elastic as more alternatives are generated.

- Consumers dislike new taxes and often don’t believe that they will be ‘revenue neutral’. This is not an economic argument, but it is a political reality and explains why it is often difficult to implement.

- A global carbon tax may curtail economic activity in the poor developing world because they can’t afford the small increase in energy costs, but the developed world may simply be able to pay. There may be a need for a carbon tax to reflect different abilities to pay.