What would be the impact of the US placing a tariff on the import of steel and aluminium into the US

A tariff on imports of foreign steel would raise the price of imported steel and encourage US firms and consumers to buy domestically produced steel instead. At the moment, American producers find it cheaper to import steel from Canada, China and Europe so the feeling is US steel producers are losing out. Some commentators argue cheap imports and the US trade deficit is a factor behind the decline of US steel industry and jobs in the steel industry.

Higher tariffs on imports will cause domestic US firms to purchase more domestically produced US steel. This will benefit US steel industry and protect/create jobs in the US steel industry.

It is a similar situation with tariffs on cars from Mexico. For US consumers, it will make US produced cars relatively more attractive. A tariff on exports from Mexico will discourage US car firms moving production to Mexico and help keep US car jobs in America.

Problems of increasing US steel tariffs

However, this is only part of the equation. There are major drawbacks to placing tariffs on imports:

- More expensive prices for US consumers.

- US firms use imported steel in producing goods and so they will face higher costs of production.

- Disruption effects of firms switching from foreign imports to domestic production.

- Retaliation on US exports – harming US export industries. The EU has already threatened to retaliate by placing tariffs on US exports like Bourbon and Levi jeans.

- The threat of retaliation and a trade war will also create uncertainty as firms don’t know if they will be affected.

Higher prices for consumers

If US places tariffs on imports of steel and cars, this will lead to higher costs of production and higher prices for consumers. The rise in price may be relatively marginal, but spread over the whole economy, the rise in prices will reduce discretionary (disposable) income. This, in turn, will lead to a decline in demand for other goods produced in the US.

This effect of higher prices is less noticeable than say highly visible job losses in the steel industry. But, if tariffs lead to higher prices, other firms in the US economy will be imperceptibly affected, with a decline in demand for other goods.

Increased costs of imported raw materials

Trade is not a black and white issue. Most firms are now global multinationals, a US car firm doesn’t source everything from the US, but will import a percentage of its supply chain. Some US exporters will face higher costs as a result of these US tariffs, and they will face a decline in international competitiveness.

Disruption effects

If tariffs are placed on imports, firms may have to renegotiate deals and find new suppliers. Some firms will gain, some will lose, but this process has costs and time disrupting economic efficiency.

Retaliation

If the US place tariffs on Chinese imports, China can retaliate and place tariffs on US exports. For example, China has, in the past, threatened to block iPhones, soybean and maize exports. As a Chinese paper stated, in retaliation to Chinese imports, China could:

A batch of Boeing orders will be replaced by Airbus. US auto and iPhone sales in China will suffer a setback, and US soybean and maize imports will be halted. China can also limit the number of Chinese students studying in the US. (link)

Last week, the European Commission President Jean-Claude Juncker discussed putting retaliatory tariffs on blue jeans, bourbon, and Harley-Davidson motorcycles – iconic US exports.

On 3 March 2018, Trump tweeted if EU put retaliatory tariffs on US exports, he would retaliate to their retaliation

“If the E.U. wants to further increase their already massive tariffs and barriers on U.S. companies doing business there, we will simply apply a Tax on their Cars which freely pour into the U.S. They make it impossible for our cars (and more) to sell there. Big trade imbalance!” (Twitter)

It is unusual for a country to put up tariffs without some kind of retaliation. What would happen in this case is that tariffs would shift resources. It would benefit some industries (steel / cars) which benefit from the import tariffs. But, equally, it would harm the export industries where the US has more of a comparative advantage.

In terms of jobs, tariffs create winners and losers, but overall unemployment would not be reduced.

Economic instability

A trade war could destabilise investment and lead to economic uncertainty. Nearly all economists agree that a tit for tat trade war can only cause everyone to be worse off. In the long-term, it can undermine trade relations.

Tariffs and Full capacity

As Paul Krugman notes (Trade War – What is it good for? Nothing) – if you place tariffs on imports when the economy is close to full capacity, domestic supply may not be able to meet the new demand. In this case, domestic suppliers will put up prices and cause inflationary pressure. In response to inflation, the Fed may increase interest rates – which increases the value of the dollar and makes US exports less competitive.

Krugman notes that if there was high unemployment and a trade deficit from an overvalued dollar – there may be a stronger case for government intervention. But, trying to shift demand to the US and bring back lost jobs – is much more difficult when the economy is at full capacity. (US unemployment currently 4%)

Can the steel industry be saved by tariffs?

The US steel industry has been in long-term decline since the 1960s. Just like the coal industry and railroads. But, that is the nature of capitalist economies – or as Joseph Schumpeter said it is part of the ‘Creative destruction‘ of capitalism.

Industries wanting tariffs are usually those which are losing international competitiveness and in long-term decline – the industries which can’t compete with foreign firms. Some argue tariffs can merely prolong the economic inefficiency of supporting inefficient firms. It is better to promote industries, where the US has a more obvious comparative advantage e.g. – Boeing, iPhones, International students.

Evaluation

- One defence for higher tariffs could be that US firms are not actually facing fair competition. For example, if the ultra low Chinese steel prices are due to state supported over-capacity. This over-capacity is driving prices below their long-term equilibrium. If the US steel industry closes down, it would give China more monopoly power and, in the future, they could raise prices significantly. Therefore, on the grounds of promoting international competition, there is a justification to try and protect the industry from this unusual situation of ultra-low prices.

- I’m not sure how valid this point is – I’m not sure that the Chinese over-capacity will prove temporary. Even if true, tariffs will still lead to the problem of retaliation and higher prices.

- Another argument which used to be made is that China was a currency manipulator – artificially reducing its currency to give exporters an unfair advantage. This may have been true a few years ago but – given the recent appreciation in the value of the Chinese Yuan – most economists would no longer accept it as a fair accusation.

Conclusion

In summary, tariffs can be useful for offering temporary support for a particular industry. But, tariffs need to be viewed in the wider context of how they are very likely to cause problems for other industries and the wider economy. Tariffs don’t really tackle with the fundamental issues of regional decline, rising inequality and technology related job losses.

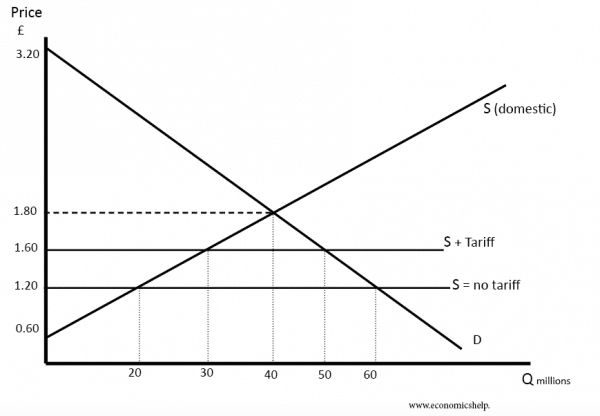

Diagram showing effect of Tariffs

- Without any trade, the equilibrium price is £1.80 and a quantity of 40 million

- With a tariff of £0.40, the price of imports will be £1.60.

- The quantity of imports at £1.60 is (50-30) = 20 million.

- See more at: effect of tariffs

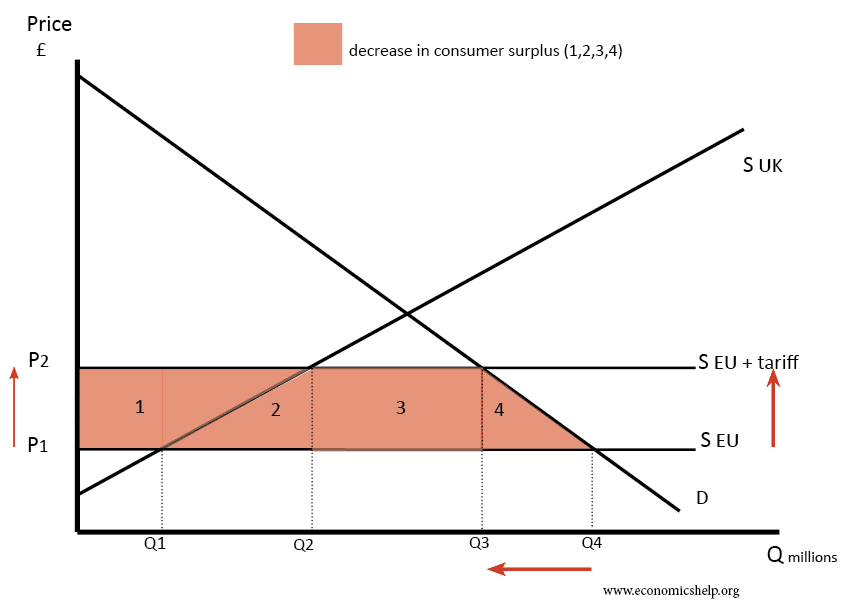

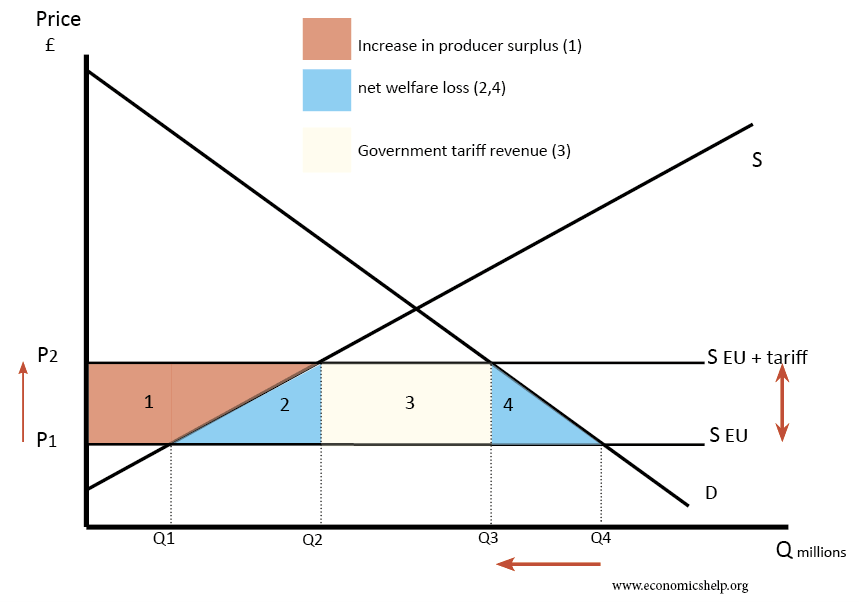

Welfare effects of higher tariffs

Firstly a tariff on imports reduces consumer surplus by areas 1,2,3,4.

There is some gains – tariff revenue and boost to domestic supply. But, overall there is a net welfare loss of areas 2+4.

This is just effect of US tariffs. If there is retaliation, there will be even greater welfare loss.