Increased government spending is likely to cause a rise in aggregate demand (AD). This can lead to higher growth in the short-term.

Higher government spending will also have an impact on the supply-side of the economy – depending on which area of government spending is increased.

Higher government spending could be on

- Welfare benefits – this spending will help to reduce levels of inequality. There is potential higher welfare benefits could reduce incentives to work, but on the other hand

- Pension spending – ageing population, requires higher government spending, but this has no impact on boosting productivity

- Education and training – if successfully targetted government spending can increase labour productivity and enable higher long-term economic growth.

- Infrastructure investment – Higher spending on roads and railways can help remove supply bottlenecks and enable greater efficiency. This can also boost long-term economic growth.

- Higher debt interest payments – If the government has higher debt and higher bond yields, then it can cause increased costs of borrowing. This spending will go to investors and have no benefit for the economy.

Evaluation of higher government spending

It depends on how the government spending is financed. If government spending is financed by higher taxes, then tax rises may counter-balance the higher spending, and there will be no increase in aggregate demand (AD).

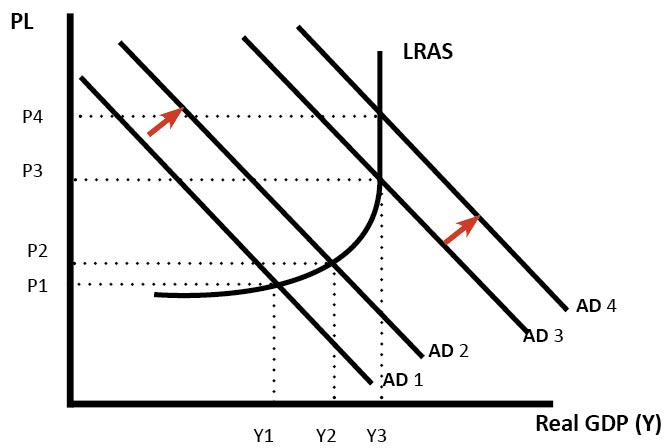

Crowding out. If the economy is close to full capacity, higher government spending can lead to crowding out. This is when the government spends more, but it has the effect of reducing private sector spending. For example, if government borrow from the private sector, the private sector has lower savings for private investment.

The impact of government spending also depends on the state of the economy. If the economy is close to full capacity, then higher government spending may cause inflationary pressures and little increase in real GDP. If the economy is in recession, and the government borrows from the private sector, it can act as expansionary fiscal policy to boost economic growth

Readers Question: Why will real GDP tend to rise when government spending and taxes rise by the same amount?

This is a controversial assertion in economics. Certainly many wouldn’t agree.

It is more likely that the rise in taxes will negate the impact of rising government spending. This would leave Aggregate Demand (AD) unchanged.

However, it is possible increased spending and tax rises could lead to an increase in GDP.

In a recession, consumers may reduce spending leading to an increase in private sector saving. Therefore a rise in taxes may not reduce spending as much as usual.

The increased government spending may create a multiplier effect. If government spending causes the unemployed to gain jobs, then they will have more income to spend leading to a further increase in aggregate demand. (e.g. construction workers employed by government increase spending in pubs and transport, causing other sectors of the economy to benefit from the government spending). In these situations of spare capacity in the economy, the government spending may cause a bigger final increase in GDP than the initial injection.

However, if the economy was at full capacity, the increased government spending would tend to crowd out the private sector leading to no net increase in AD from switching from private sector spending to government sector spending.

Some economists would argue increasing government spending through higher taxes would lead to a more inefficient allocation of resources as governments tend to be less effective in spending money.

Another consideration is that an economy may grow at 2.5% a year. If there is higher government spending, this growth rate continues. But, the growth is not due to the rising government spending. The government spending just fails to change the growth rate.