C. P. Chandrasekhar and Jayati Ghosh

The government’s confused policy response to the rupee’s decline signals its growing concern about India’s external payments position in general, and the deteriorating current account balance, in particular. The rupee’s recent depreciation had initially been dismissed as reflecting global developments that affected all emerging markets, and not just India. In this view, expectations that developed country central banks would accelerate the process of unwinding their easy money policies and raising interest rates from near-zero levels were resulting in the exit of portfolio investors from emerging markets. Combined with increased demand for dollars to finance much more expensive oil imports, this was putting pressure on emerging market currencies that have been declining relative to the dollar. But since this was true of India’s trading competitors as well, the argument went, there was not much cause for concern.

However, it was soon clear that such complacency was unwarranted. Though the rupee was not battered as much as the Argentinian peso or Turkish lira, its decline was sharp enough to suggest that markets had placed India among the group of countries whose currencies were particularly vulnerable. Indeed, the rupee was the worst performing Asian currency. This evidence of excess vulnerability turned attention to India’s balance of payments. Is India, in the view of the fickle portfolio investor, externally vulnerable for reasons other than the shifts in monetary policy in the advanced nations?

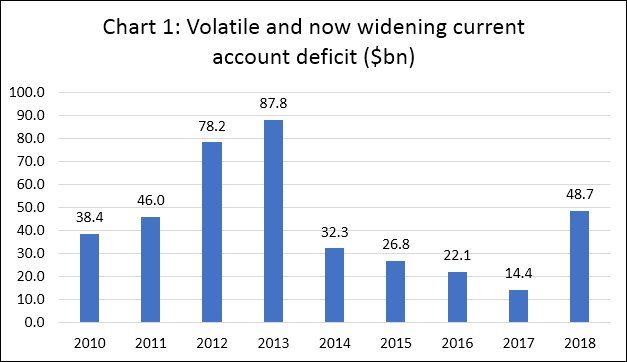

One obvious indicator of such vulnerability is the growing current account deficit, which widened from $14.4 billion in 2016-17 to $48.7 billion in 2017-18 (Chart 1). Things have not improved subsequently, since the deficit over April-June 2018 was, at $15.8 billion, a tad higher than the $15 billion recorded in the corresponding quarter of 2017. Official projections place the current account deficit at 2.6 per cent of GDP in 2018-19, but there is a strong likelihood of it being closer to 3 per cent or even more.

However, when compared with 2012-13 and 2013-14, when the current account deficit stood at $78 billion and $89 billion respectively, its current level appears manageable. If the rupee’s position is fragile nonetheless, this must be because the deficit is widening precisely at a time when portfolio investors are inclined to move out of emerging markets. The widening deficit serves to dispel any doubts they may have whether they should exit, accelerating the outflow. According to the Reserve Bank of India, the net outflow of portfolio capital amounted to $8.1 billion in the first quarter of 2018-19, as compared with an inflow of $12.5 billion in the corresponding quarter of the previous year. This, combined with the RBI’s open market operations designed to provide some backing to the rupee, drained India’s foreign exchange reserves, which fell by $25 billion from its recent peak of around $425 billion.

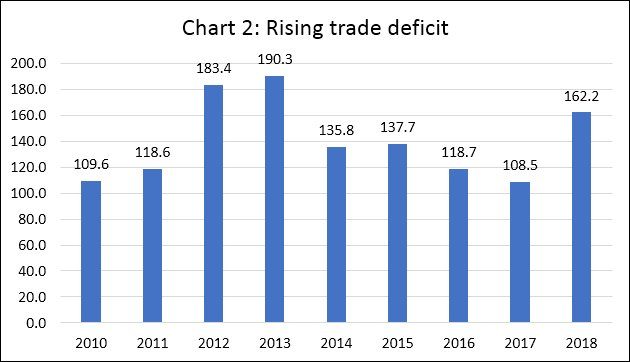

The government’s view seems to be that even this trend, while troubling, can be attributed to global factors such as the rise in oil prices that raises India’ import bill and increases its trade deficit. The international price of Brent crude has risen from $29 a barrel in mid-January 2016 to close to $80 a barrel by mid-September 2018. As a result, India’s net petroleum products import bill, which fell from $165 billion in 2013-14 (when crude prices touched $110 a barrel) to $83 billion in 2015-16, has risen to touch $109 billion in financial year ending March 2018. As a result, the trade deficit has shot up in 2017-18 by around 50 per cent to touch $162.2 billion (Chart 2).

India’s oil import dependence is clearly a problem. But, given the multiple, technological and geopolitical factors affecting oil prices, such volatility is here to stay. So, ensuring balance of payments resilience requires an ability to ride through periods of high oil prices, without experiencing a collapse of the currency.

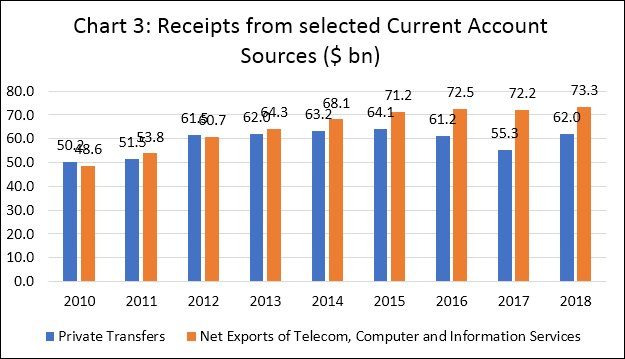

Unfortunately, India does not seem to have that capacity. This goes contrary to the view that India has developed a strong and resilient current account by being the largest recipient among developing countries of remittances from abroad and a highly successful exporter of software and information technology-enabled services. The difficulty is that receipts from these sources have been tapering off in recent times (Chart 3). The total of receipts from private transfers and from net exports of Telecom, Computer and Information Services which rose from $99 billion in 2009-10 to $135 billion in 2014-15, remained below or at that level for the next three years. The implication is that the sources that previously brought in additional foreign exchange to neutralise any increase in the trade deficit are not buoyant any more.

Underlying the stagnation in net receipts from software and information technology-enabled services (ITeS) exports is another troublesome trend. This has to do with India’s growing dependence on imports of IT and electronics goods (as opposed to services). In the years prior to the 1990s, India had adopted a policy of indigenisation and increased domestic production of IT and electronic goods to meet domestic needs. But from the early 1990s, the discovery of a potential opportunity in software exports led to an unfortunate change in position. Increasingly, IT hardware and electronics imports were liberalised, ostensibly to support the software export boom. But the real reason was the uncritical pursuit of a liberalisation agenda by leveraging the success in IT-enabled services exports. This occurred at a time when the government had committed itself to computerisation and the promotion of digital interaction in various spheres. These developments, as well as the media and mobile telephony boom, boosted imports of information technology and electronic products.

One consequence of this has been that the foreign exchange bill on account of imports of these products is now matching or exceeding receipts from software and IT-enabled exports. At a more aggregate commodity group level, this is reflected in the fact that the value of imports of Electronic Goods within the Capital Goods Category, which amounted to 46 per cent of the receipts from net exports of Telecom, Computer and Information Services in 2009-10, rose to 58 per cent of the latter figure in 2016-17 and 70 per cent in 2017-18. Clearly, the imports of information technology and electronic goods, which face little or no competition from domestic production, are rising much faster that the exports of IT-enabled services, given the surge in domestic demand from both the government and the private sectors. This has undermined the role of IT-enabled services exports as a source of rising foreign exchange earnings that can make the current account of India’s balance of payments more resilient.

Given these structural weaknesses in the current account, which are on occasion intensified by factors like private gold imports, India is deeply vulnerable when faced with outflows of investment on the capital account. Unfortunately, it is more likely to be the victim of such outflows, given the huge amount of footloose capital that has come into the country in the aftermath of capital account liberalisation since the early 1990s.

(This article was originally published in the Business Line on September 25, 2018)