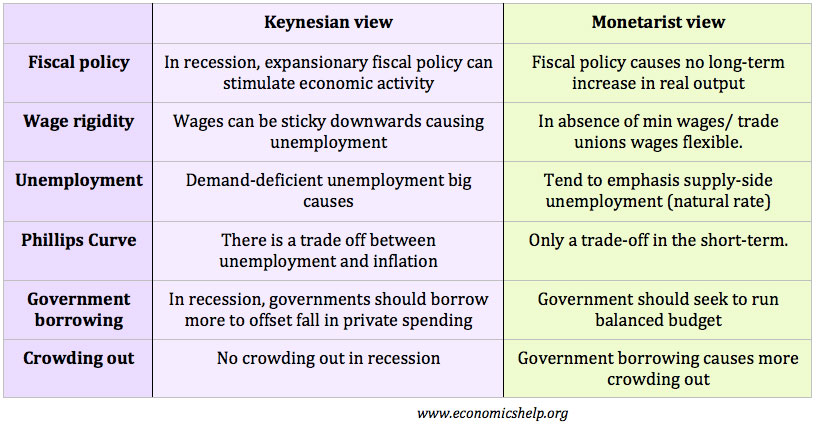

Readers Question: Could you give a summary of Keynesian and Classical views?

Summary

- Classical economics emphasises the fact that free markets lead to an efficient outcome and are self-regulating.

- In macroeconomics, classical economics assumes the long run aggregate supply curve is inelastic; therefore any deviation from full employment will only be temporary.

- The Classical model stresses the importance of limiting government intervention and striving to keep markets free of potential barriers to their efficient operation.

- Keynesians argue that the economy can be below full capacity for a considerable time due to imperfect markets.

- Keynesians place a greater role for expansionary fiscal policy (government intervention) to overcome recession.

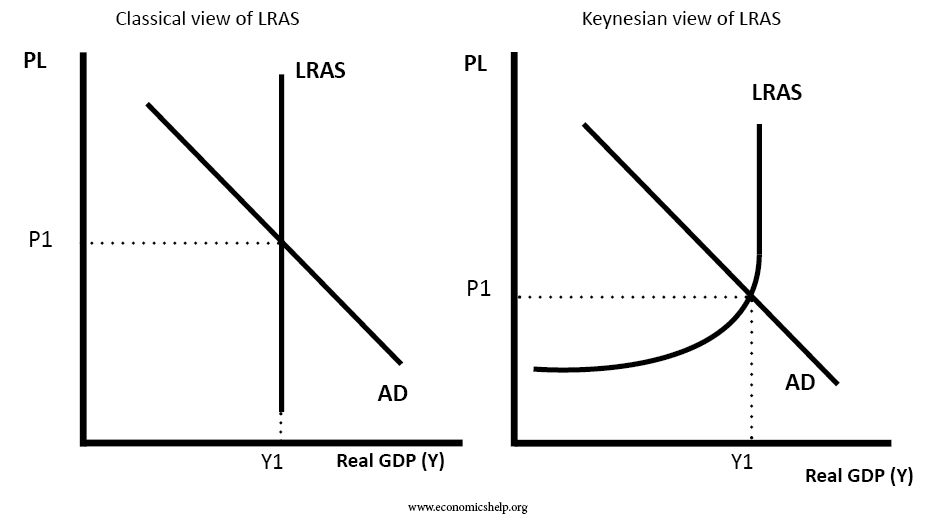

Shape of long-run aggregate supply

A distinction between the Keynesian and classical view of macroeconomics can be illustrated looking at the long run aggregate supply (LRAS).

Classical view of Long Run Aggregate Supply

The Classical view is that Long Run Aggregate Supply (LRAS) is inelastic. This has important implications. The classical view suggests that real GDP is determined by supply-side factors – the level of investment, the level of capital and the productivity of labour e.t.c. Classical economists suggest that in the long-term, an increase in aggregate demand (faster than growth in LRAS), will just cause inflation and will not increase real GDP>

Keynesian view of Long Run Aggregate Supply

The Keynesian view of long-run aggregate supply is different. They argue that the economy can be below full capacity in the long term. Keynesians argue output can be below full capacity for various reasons:

- Wages are sticky downwards (labour markets don’t clear)

- Negative multiplier effect. Once there is a fall in aggregate demand, this causes others to have less income and reduce their spending creating a negative knock-on effect.

- A paradox of thrift. In a recession, people lose confidence and therefore save more. By spending less this causes a further fall in demand.

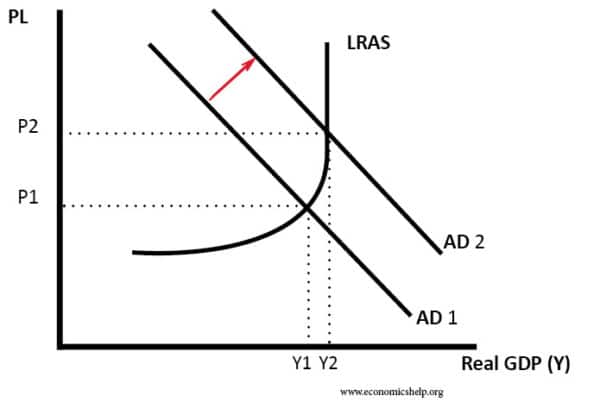

Keynesians argue greater emphasis on the role of aggregate demand in causing and overcoming a recession.

2. Demand deficient unemployment

Because of the different opinions about the shape of the aggregate supply and the role of aggregate demand in influencing economic growth, there are different views about the cause of unemployment

- Classical economists argue that unemployment is caused by supply side factors – real wage unemployment, frictional unemployment and structural factors. They downplay the role of demand deficient unemployment.

- Keynesians place a greater emphasis on demand deficient unemployment. For example the current situation in Europe (2014), a Keynesian would say that this unemployment is partly due to insufficient economic growth and low growth of aggregate demand (AD)

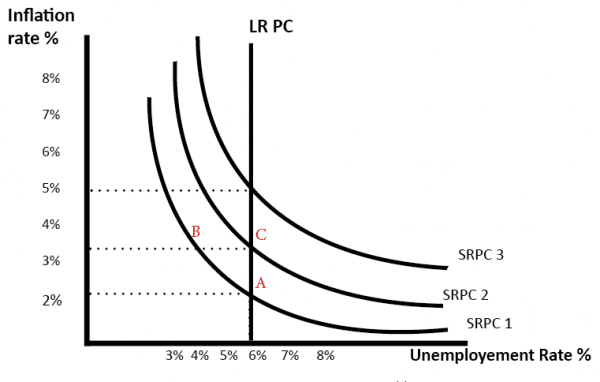

3. Phillips Curve trade-off

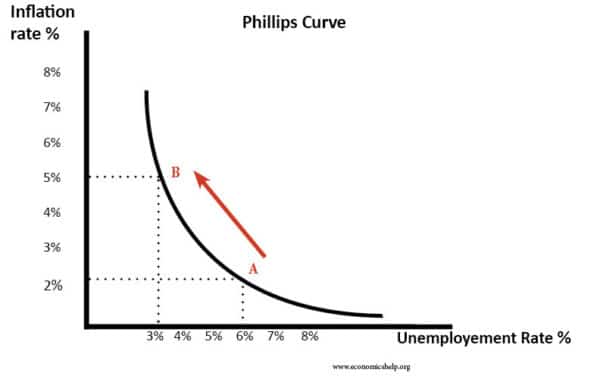

A classical view would reject the long-run trade-off between unemployment, suggested by the Phillips Curve.

Classical economists say that in the short term, you might be able to reduce unemployment below the natural rate by increasing AD. But, in the long-term, when wages adjust, unemployment will return to the natural rate, and there will be higher inflation. Therefore, there is no trade-off in the long-run

Keynesians support the idea that there can be a trade-off between unemployment and inflation. See: Phillips curve

In a recession, increasing AD will lead to a fall in unemployment, though it may be at the cost of higher inflation rate.

4. Flexibility of prices and wages

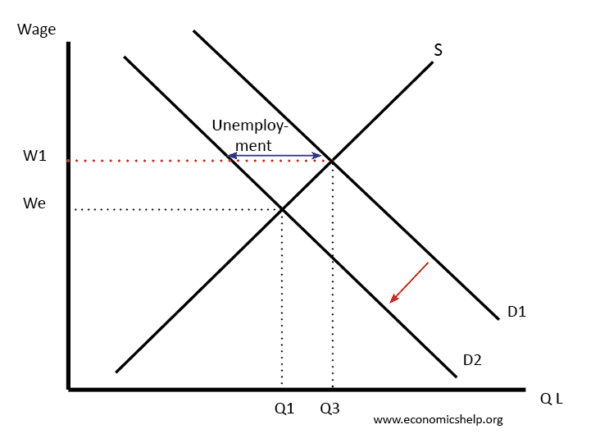

In the classical model, there is an assumption that prices and wages are flexible, and in the long-term markets will be efficient and clear. For example, suppose there was a fall in aggregate demand, in the classical model this fall in demand for labour would cause a fall in wages. This decline in wages would ensure that full employment was maintained and markets ‘clear’.

A fall in demand for labour would cause wages to fall from W1 to We

However, Keynesians argue that in the real world, wages are often inflexible. In particular, wages are ‘sticky downwards’. Workers resist nominal wage cuts. For example, if there were a fall in demand for labour, trade unions would reject nominal wage cuts; therefore, in the Keynesian model, it is easier for labour markets to have disequilibrium.Wages would stay at W1, and unemployment would result.

A Keynesian would argue in this situation the best solution is to increase aggregate demand. In a recession, if the government did force lower wages, this might be counter-productive because lower wages would lead to lower spending and a further fall in aggregate demand.

5. Rationality and confidence

Another difference behind the theories is different beliefs about the rationality of people.

- Classical economics assumes that people are rational and not subject to large swings in confidence. (see: Rational economic man)

- Keynesian economics suggests that in difficult times, the confidence of businessmen and consumers can collapse – causing a much larger fall in demand and investment. This fall in confidence can cause a rapid rise in saving and fall in investment, and it can last a long time – without some change in policy.

Difference in policy recommendations

1. Government spending

- The classical model is often termed ‘laissez-faire’ because there is little need for the government to intervene in managing the economy.

- The Keynesian model makes a case for greater levels of government intervention, especially in a recession when there is a need for government spending to offset the fall in private sector investment. (Keynesian economics is a justification for the ‘New Deal’ programmes of the 1930s.)

2. Fiscal Policy

- Classical economics places little emphasis on the use of fiscal policy to manage aggregate demand. Classical theory is the basis for Monetarism, which only concentrates on managing the money supply, through monetary policy.

- Keynesian economics suggests governments need to use fiscal policy, especially in a recession. (This is an argument to reject austerity policies of the 2008-13 recession.

3. Government borrowing

- A classical view will stress the importance of reducing government borrowing and balancing the budget because there is no benefit from higher government spending. Lower taxes will increase economic efficiency. (e.g. at the start of the 1930s, the ‘Treasury View‘ argued the UK needed to balance its budget by cutting unemployment benefits.

- The Keynesian view suggests that government borrowing may be necessary because it helps to increase overall aggregate demand.

4. Supply side policies

- The classical view suggests the most important thing is enabling the free market to operate. This may involve reducing the power of trade unions to prevent wage inflexibility. Classical economics is the parent of ‘supply side economics‘ – which emphasises the role of supply-side policies in promoting long-term economic growth.

- Keynesian don’t reject supply side policies. They just say they may not always be enough. e.g. in a deep recession, supply side policies can’t deal with the fundamental problem of a lack of demand.