A look at different methods to reduce budget deficits. A budget deficit occurs when a government spending is greater than tax revenues. This leads to an accumulation of public sector debt. If the deficits are unsustainable, this can cause rising bond yields (higher interest payments) and in the worse case, lead to a loss of confidence in the government. Though this is quite rare for countries with their own currency (i.e. not in Euro)

The obvious way to reduce a budget deficit is to increase tax rates and cut government spending. However, the difficulty is that this fiscal tightening can cause lower economic growth – which in turn can cause a higher cyclical deficit (government get less tax revenue in a recession). The best way to reduce fiscal deficits depends on the situation a country is in.

Different policies to reduce a budget deficit.

1. Cut government spending

The government can cut its public spending to reduce its fiscal deficit. For example, in the 1990s, Canada reduced its public spending quite significantly. They evaluated many different departments and cut spending by up to 20% within four years across the board. This proved a successful policy in reducing the budget deficit. During this period of spending cuts, the Canadian economy continued to grow which also helped reduce the budget deficit. However, during the spending cuts, the Canadian economy benefited from lower interest rates to boost spending, higher exports to the US, and a weaker exchange rate. The strong economy made it much easier to cut spending.

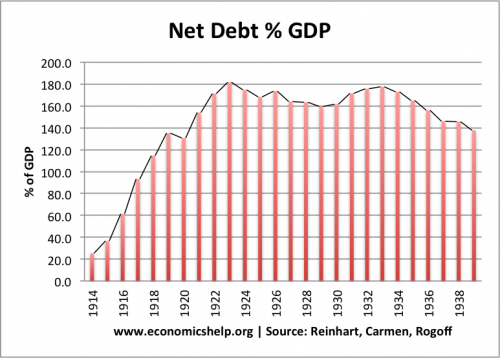

In the 1920s, the UK cut spending drastically, (known as the Geddes Axe) but, combined with the gold standard (fixed exchange rate), this contributed to deflation and lower growth. Therefore, in this period, the government was relatively unsuccessful in reducing the debt to GDP ratio.

– see: UK economy in the 1920s

This graph shows that – despite two decades of austerity, and cuts to government spending – the UK was unsuccessful in reducing historically high levels of debt.

In the Eurozone crisis, many European countries have cut government spending to try and reduce their budget deficits. For example, Greece, Ireland and Spain have all cut spending. However, these spending cuts have contributed to a decline in economic growth, leading to lower tax revenues and rising debt to GDP. These spending cuts have been much less effective in reducing the budget deficit because these countries can’t devalue (Euro is a fixed exchange rate), they can’t pursue a loosening of monetary policy and the Eurozone is in recession. Therefore, spending cuts have been less effective in reducing the deficit but also caused further economic problems. See also: Eurozone austerity.

Other Evaluation of Cutting Government spending

It depends on the type of government spending you cut. If you cut pension spending (e.g. make people work longer), then there may be an actual increase in productive capacity. If you cut public sector investment, it will have a bigger adverse effect on aggregate demand and the supply side of the economy. Therefore, the temptation is for the government to cut benefits and pensions as this can reduce spending with less impact on economic growth – but it will be at the cost of increased inequality in society.

2. Tax increases

Higher taxes increase revenue and help to reduce the budget deficit. Like spending cuts, they could cause lower spending and lead to a fall in economic growth. Again it depends on the timing of tax increases. In a recession, tax increases could cause a significant drop in spending. During high growth, tax increases won’t harm spending as much. It also depends on the type of tax you increase. Recently, France increased taxes on the rich to over 70% – however, some have complained this is too high and creates disincentives to work in France. If high marginal tax rates do reduce incentives to work, the tax revenue raised may be less than planned. See: French economic austerity.

3. Economic growth

One of the best ways to reduce the budget deficit as a % of GDP is to promote economic growth. If the economy grows, then the government will increase tax revenue, without raising taxes. With economic growth, people pay more VAT, companies pay more corporation tax (tax on profits), and workers pay more income tax. High economic growth, is the least painful way to reduce the budget deficit because you don’t need to raise tax rates or cut spending. However, many countries with fiscal deficit crisis are often stuck in recession. Countries in the Eurozone currently find it difficult to grow because of the nature of European monetary policy and the constraints of the Euro. Also, economic growth may not solve the underlying structural deficit (which occurs even during high growth) This may still require spending cuts or tax rises.

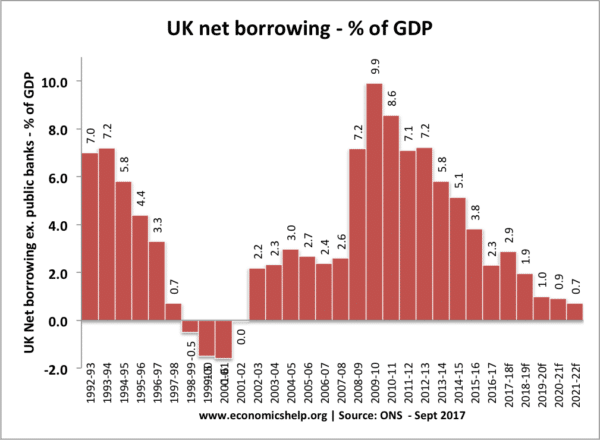

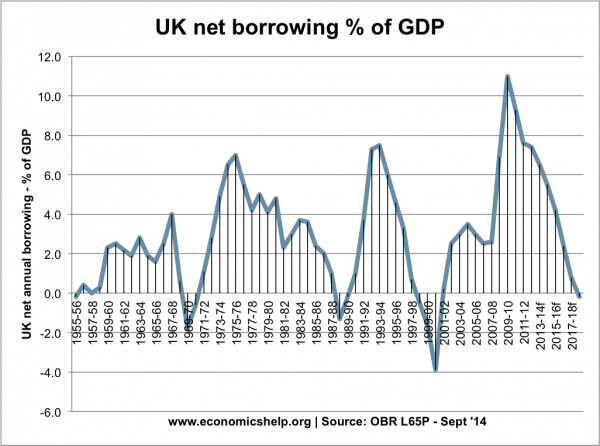

UK Budget deficit

This graph shows that during a period of high economic growth in the 1980s, the UK budget deficit fell – despite tax cuts. In the recession of 1991, the budget deficit increased sharply. This shows the cyclical nature of budget deficits and the importance of economic growth to reducing a deficit.

Bailout

In some circumstances, countries can be eligible for a bailout from an international organisation, such as the IMF. This means they can draw on temporary funds to help with temporary liquidity shortages. The bailout may reassure investors and give the country more time for dealing with the deficit. For example, in the 1970s, the UK applied for bailout funds from the IMF. A bailout usually comes with strict instructions on reducing the deficit – this may be politically easier when it is enforced from the outside. However, in the case of severely indebted countries, a bailout may be insufficient to deal with the underlying level of debt. Also, bailout conditions can be highly controversial.

Default

Sometimes countries have got to the stage where they can’t manage their budget deficit. Arguably Greece is very close. The government have tried spending cuts and tax increases, but the budget deficit continues to be large. Also, the fiscal consolidation has caused an economic depression. Therefore, they may be better off defaulting, leaving the Euro and starting again. Should Greece leave the Euro? In the past countries, such as Argentina and Russia have defaulted. The problem with defaulting is that it destroys the savings of investors, and will make it difficult to borrow again from capital markets.

UK experience since 2010

A central plank of the Conservative policy since winning the 2010 election has been to reduce the budget deficit. This has led to a mild form of austerity. Strict spending limits, with some departments seeing a cut in spending.

UK government spending as a % of GDP has fallen significantly.

However, the budget deficit has fallen more slowly than expected this is because:

- Low rate of economic growth (caused by weak global growth and the impact of austerity)

- Growing demand for social security spending (e.g. rising house rents, leading to higher spending on housing benefit)

- Growing expenditure on pensions (due to ageing population and triple lock guarantee)

Summary

To reduce fiscal deficits, the government is likely to use a combination of policies. A key factor is the timing of deficit reduction plans. If the country is already in recession, it is much more difficult to reduce the deficit because fiscal consolidation tends to worsen the economic situation leading to lower tax revenues. In some cases, austerity can even be self-defeating.

The best way to reduce the budget deficit is to aim for positive economic growth, but in the long-term evaluate government spending commitments and reduce spending to sustainable levels.