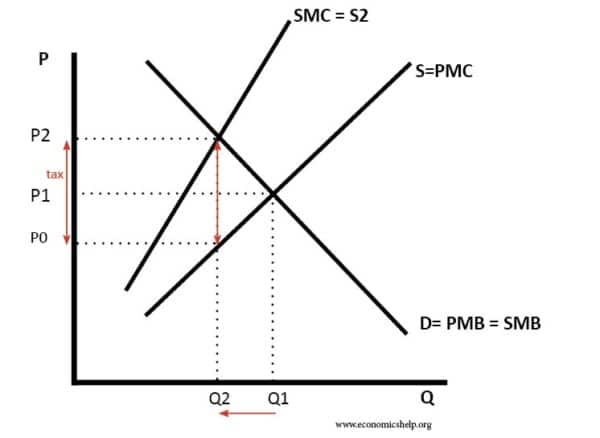

Taxes on negative externalities are intended to make consumers / producers pay the full social cost of the good. This reduces consumption and creates a more socially efficient outcome.

If a good has a negative externality, without a tax, there will be over-consumption (Q1 where D=S) because people ignore the external costs.

1. Taxes on Negative Externalities

- A tax should be placed on the good equal to the external marginal cost. It means that consumers will end up paying the full social marginal cost.

- If the external costs of driving a car are estimated at 2p per mile, this is how the tax on petrol should be calculated.

- A tax enables the harmful effects to be internalised.

- After the tax is implemented, the output of the good will fall from Q1 to Q2. Q2 is socially efficient because at this level the social marginal benefit (SMB) = Social marginal cost (SMC)

Disadvantages of taxes

- Difficult to measure the level of negative externality e.g. what is the cost of pollution from a car?

- If demand is inelastic, then higher taxes will not reduce demand much. For example, it is hard to solve the problem of congestion at rush hour, if there are no alternatives to driving.

- Taxes will cause inequality. A tax on cigarettes takes a higher percentage of income from those on low-income.

- Cost of administration – the cost of collecting taxes. For example, how would you collect a tax from those who drop litter?

- Possibility of evasion. For example, with a new tax on disposing of rubbish, there has been an increase in fly tipping (illegal dumping of rubbish) Therefore, taxes can create unintended consequences.

- May be difficult to decide who is causing pollution.

Advantages of Taxes

- Provides incentives to reduce the negative externality such as pollution. E.g. cars have become more fuel efficient due to increased petrol tax.

- Social efficiency, 1st best solution (where MSC = MSB)

- Taxes raise revenue for the government. This can be spent on alternatives, such as public transport or the tax revenue can be used to tackle the problems relating to the externality, such as Sugar tax – money goes to health care.