Balance of Payments

The Balance of Payments is a record of a country’s transactions with the rest of the world. It shows the receipts from trade. It consists of the current and financial account

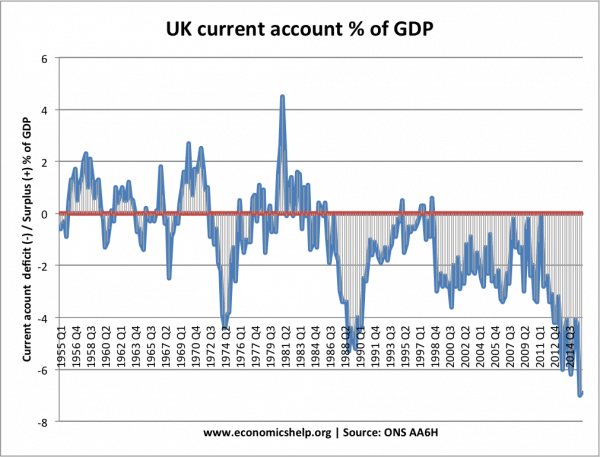

UK current account 1955-2015

UK current account 1955-2015

1. Current account

This is a record of all payments for trade in goods and services plus income flow it is divided into four parts.

- Balance of trade in goods (visibles)

- Balance of trade in services (invisibles) e.g. tourism, insurance.

- Net income flows. Primary income flows (wages and investment income)

- Net current transfers. Secondary income flows (e.g. government transfers to UN, EU)

2. Financial account

This is a record of all transactions for financial investment. It includes:

- Direct investment. This is net investment from abroad. For example, if a UK firm built a factory in Japan it would be a debit item on UK financial account)

- Portfolio investment. These are financial flows, such as the purchase of bonds, gilts or saving in banks. They include

- short-term monetary flows known as “hot money flows” to take advantage of exchange rate changes, e.g. foreign investor saving money in a UK bank to take advantage of better interest rates – will be a credit item on financial account

3. Capital Account

This refers to the transfer of funds associated with buying fixed assets such as land

4. Balancing Item

In practice when the statistics are compiled there are likely to be errors, therefore, the balancing item allows for these statistical discrepancies.

- (note the Financial Account used to be called the Capital Account, which is potentially quite confusing. Even now some people refer to financial account as the capital account)

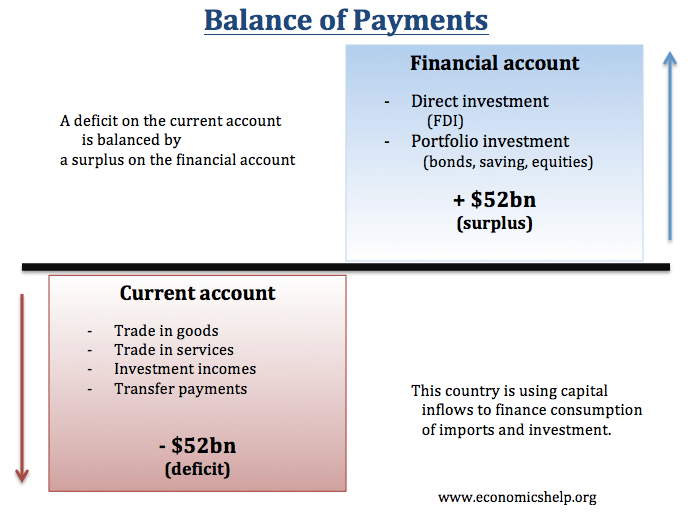

Balance of payments equilibrium

- In a floating exchange rate the supply of currency will always equal the demand for currency, and the balance of payments is zero.

- Therefore if there is a deficit on the current account there will be a surplus on the financial/capital account.

- If there was an increase in interest rates this would cause hot money flows to enter the UK, therefore there would be a surplus on the financial account

The appreciation in the exchange rate would make exports less competitive and imports more competitive therefore with fewer exports and more imports there would be a deficit on the current account.

Factors affecting balance of payments

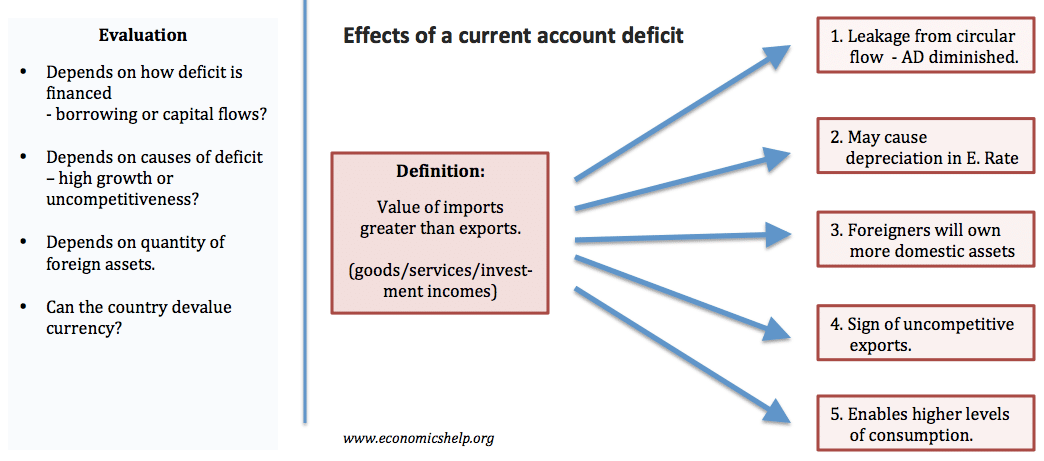

A current account deficit could be caused by factors such as.

- The high rate of consumer spending on imports (during an economic boom) – this will cause deficit.

- Decline in international competitiveness making countries exports less competitive and imports more attractive.

- Overvalued exchange rates which make exports relatively more expensive.

- Structure of economy – deindustrialisation can harm export sector.

Should we be concerned about a current account deficit?

See more detail at – should we be concerned by current account deficit?

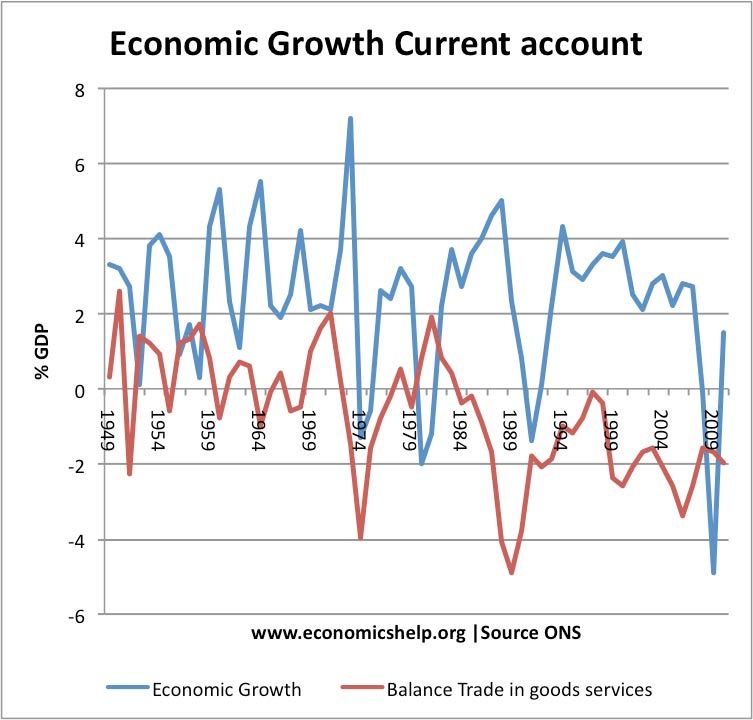

Cyclical nature of current account

In the UK, a current account deficit often increases after a period of economic growth. Higher economic growth leads to higher consumer spending and therefore more spending on imports.

In an economic downturn, spending on imports usually declines leading to a smaller current account deficit.