A Customs Union occurs when a group of countries agree to have free trade amongst themselves and agree on a common external tariff to countries outside the zone. It is a step towards a single market, but a customs union doesn’t include freedom of movement for people and goods. A customs union is often examined from the perspective of trade creation and trade diversion.

EEC Customs Union

The EEC created a Customs Union when it formed in 1957. The Customs Union was completed in 1968.

The EEC Customs Union was an important precursor to the Single Market as it abolished internal tariffs and abolished rules where you had to prove the countries origin.

Advantages of a customs union

- Free trade amongst member countries. For an area like the EU, this is a substantial part of the economy.

- Customs union eliminates the need for some regulations and customs checks at the border. Depending on the manufacturer, between 20% to 50% of the value of the supply chain is imported from the EU (Sky News).

- Note: It has been suggested that technology can implement custom checks automatically without the need to stop at borders. (UK gov – future customs relationship)

- Easier to negotiate trade deals as large economic block. Trade deals take a long time. Dealing with a block of 350 million+ people is more attractive than having to do deals with individual countries.

- A customs union is an important step towards closer to economic integration and a single market (though to those concerned over greater integration may see this as a disadvantage)

Trade deflection

- Trade deflection occurs when a country ‘cherry picks’ the country with the lowest tariff in a free trade area and then moves the good within the free trade area. A customs union with common external tariff stops this.

- For example, suppose Spain had a 30% tariff on import of steel and the UK had a 0% tariff. In that case, a US firm would export the steel to the UK (or set up a factory in UK) and then have the steel transported through the continent to Spain. In that way, the US firm can export to Spain but benefit from UK tariff rates. This is why in a free trade area, they have rules to check the country of origin and avoid this inefficient tariff avoidance) This is a reason why a common external tariff makes the most sense if you want a truly free trade area.

In free trade areas like NAFTA, there are rules to make sure you are not exporting to one then moving within free trade area – but this has an administration cost.

Disadvantages of a customs union

- A country can’t negotiate separate deals because there is a common external tariff. This reduces economic and national sovereignty. Critics of the EU argue it has meant the UK has experienced higher food prices and reduced the welfare of low-income consumers who face higher prices.

- It is worth noting – Deals can be struck if they respect the common external tariff. Turkey is in a partial EU customs union so is free to negotiate deals in other areas like agriculture where it is not bound by its customs union arrangement.

- A country cannot give preferential tariffs to a declining industry. For example, if UK steel industry was having difficulty the government might like to put tariffs on imports to protect domestic sales, however, in a customs union you can’t choose to have this separate tariff.

- Trade diversion. A common external tariff can lead to trade diversion. For example, when UK joined EEC, it had to raise tariffs on imports from the Commonwealth. This means higher prices for imports of butter and lamb.

Would a post-Brexit UK benefit from being in the EU Customs Union?

With Brexit, a question is whether the UK should join a customs union with the EU or go it alone. For example, Turkey is not in the EU, but it has a partial customs union for goods (though it excludes services and agricultural goods)

Joining a customs union would secure free trade with the EU – our biggest trading partner (roughly 50% of trade). By contrast, leaving the Customs Union could mean we could end up with a ‘no deal’ scenario and some form of tariffs with the EU, plus other costs of trade such as the rules of origin requirement. According to one government source (Times), the UK could face increased “transaction costs by an estimated 2% to 24% of the value of traded goods – if it left the customs union.

Would prices come down?

If the UK left the Customs Union, it would be in a position to reduce some external tariffs we have because of EU trade rules. This is especially true in agriculture, where EU has substantial tariffs. For example, tariffs on non-EU bananas are 14 EUR/tonne in 2017 (EU fact sheet) (though they are set to fall in future years)

30% of UK food is imported, and 70% of imports come from the EU (IFS) If we left the EU customs union, it would probably shift some food imports to outside the EU where we could benefit from lower prices. (Though some domestic UK farmers may lose out from the reduction in agricultural tariffs – however, food-exporting countries like NZ/Aus would benefit.)

Outside agriculture, the EU common external tariffs are low. The average applied tariff for the EU – and therefore for the UK – is 2.8%, and therefore there are limited gains from reducing external tariffs. Also, the trend has been to reduce EU tariffs in recent years. (Guardian link)

The price of some agricultural goods would fall and become cheaper. However, if the UK leaves the customs union and single market this fall in prices could be offset by potential new tariffs and non-tariff barriers with the EU.

The IFS examined the impact of Brexit on food prices – including a look at the impact of devaluation on raising prices since the referendum.

Free to negotiate new deals

If the UK was outside any formal customs union, it would be free to negotiate any trade deals with countries around the world. Lower agricultural tariffs may be attractive to countries like Argentina and New Zealand would like to export more agricultural goods to the UK. However, negotiating free trade deals with many countries could take years – and there is no guarantee the desired free trade deals will be struck. Also, even in a customs union, there is scope for negotiating trade deals – so long as the common external tariff is respected. One option would be for a partial customs union, where the UK stays in customs union but excludes a sector like agriculture.

Levels of Economic integration

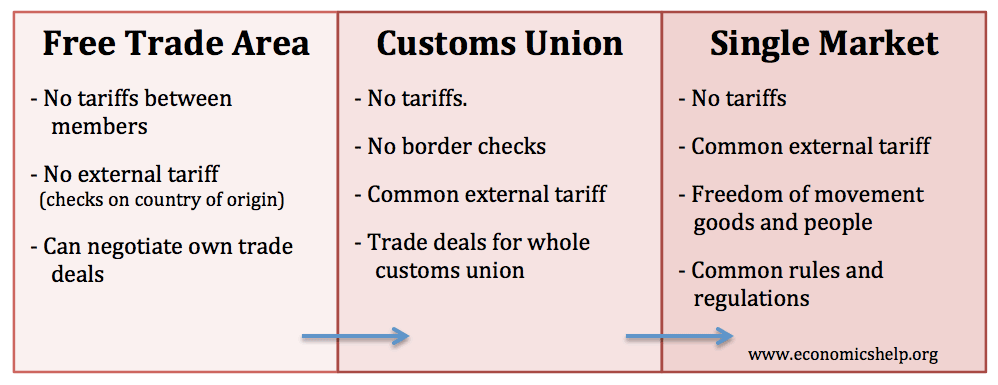

Difference between customs union and Free Trade Area

A free trade area does not have a common external tariff and countries are free to pursue their own trade deals.

Free Trade areas have rules-of-origin requirements to prove where products came from. A customs union doesn’t have this. In other words, once a good is imported into any country in the EU customs union, that can be freely traded around the EU.

Difference between customs union and single market

- A customs union has free trade and common external tariff

- A single market has free movement of people, goods and services. If you are in the customs union, you don’t have to accept the freedom of movement of goods and people which Single Market membership entails.

- Countries like Norway pay substantial sums to get Single Market access.

- A single market aims to have common rules and regulations about the quality of products.