The current US administration have suggested they want to increase the US budget deficit to enable higher rates of economic growth. What does economic theory state about this idea?

“We need to have new deficits because of that. We need to have the growth,” Mulvaney said. “If we simply look at this as being deficit-neutral, you’re never going to get the type of tax reform and tax reductions that you need to get to sustain 3 percent economic growth.”

White House Budget Director, Mick Mulvaney. Source: Bloomberg

Basically, this is an argument for allowing higher budget deficit because increased tax cuts will lead to higher economic growth.

What is the economics behind this?

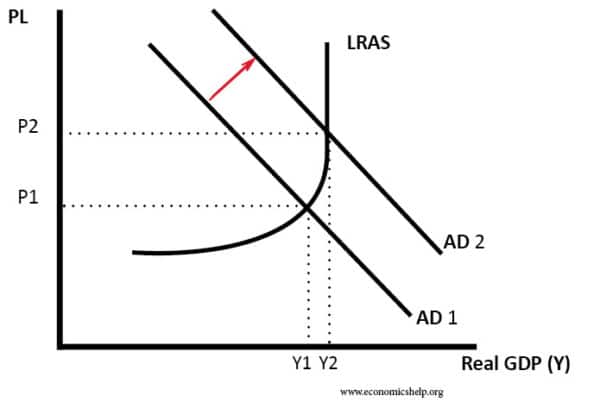

Tax cuts increase disposable income and so will increase consumer spending and aggregate demand. Higher demand will lead to increased economic growth, at least in the short-term.

Tax cuts boost aggregate demand, leading to higher real GDP.

Tax cuts for business increase their retained profit and will enable more investment. This investment will increase both aggregate demand and, in the long-term, supply-side capacity.

Income tax cuts will encourage people to work more, increase productivity and increase economic growth rates. This analysis is based partly on the Laffer Curve analysis – which suggests tax cuts can actually increase tax revenue because, with lower tax rates, people will work more leading to more tax revenue.

Lower corporation tax rates may encourage more US firms to keep taxable revenue in US, rather than use offshore subsidiaries, e.g. Ireland, Luxembourg, The Bahamas. In this way, corporation tax revenue could increase.

Problems with this economic analysis

- As the US economy is already growing by 2.5-3%, there is limited spare capacity, increasing consumer spending and aggregate demand may come up against supply constraints.

- If the aggregate demand does rise and short-term growth picks up – it is likely to cause an uptick in inflation. If inflation rises, the Federal Reserve is likely to raise interest rates – to keep inflation on target. Therefore, the expansionary effect of tax cuts will be offset by tighter monetary policy.

- Firms are unlikely to increase investment as a result of tax cuts. Corporations already have high levels of retained profit and savings. Corporation tax cuts may encourage some investment, but tax rates are not the major determiner of business investment.

- The supply-side benefits of income tax cuts are likely to be very limited. Laffer curve analysis works when tax rates are very high 80-90%. But, the proposal is to cut the top rate of income tax from 39.6 percent to 35%. Tax rates are already relatively low. It is not the case millions of US workers are being idle waiting for tax rates to be cut to 35%. There is also an income and substitution effect of tax cuts – which means the effect on labour supply is uncertain.

- The US long-run productivity growth is driven by labour productivity, technological growth, innovation – not tax rates.

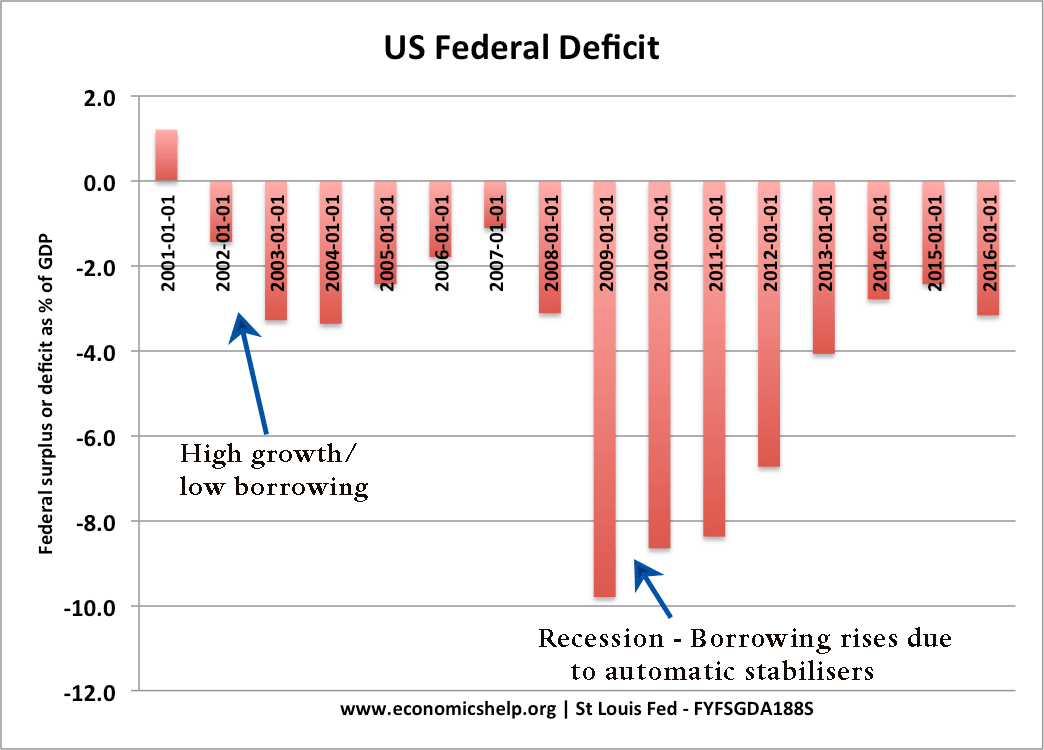

- Crowding out effects. With the national debt approaching 100%, higher borrowing at this stage in the economic cycle could cause crowding out. Bigger deficits, during periods of economic growth, are likely to push up bond yields on debt. Higher interest rates increase the cost of interest payments and will make investment more expensive. Also, if the economy grows strongly, demand for buying ‘safe US bonds’ is likely to become relatively weaker than it was during the great recession when there is a higher demand for safe, low-interest bearing assets.

- Deficit spending to boost growth rate is not Keynesian theory. Keynesianism is often falsely portrayed as an economic idea which supports deficit spending to increase economic growth at all times. But, this is a mistake. Keynes only supported deficit spending to boost growth when the economy is stuck in recession – with negative economic growth and high rates of unemployment. During periods of positive economic growth – with growth close to the long-run trend rate, Keynes did not advocate deficit spending. If anything the opposite – a balanced budget to reduce debt to GDP ratio.

Can governments actually increase the long-run trend rate of growth?

The US government want a higher growth rate (as do most governments) – but past history suggests, governments struggle to actually increase the long-term trend rate of growth. So many factors, such as innovation, globalisation, automation are beyond the government’s direct control. The supply-side incentives of tax cuts are not enough to create a supply-side miracle.

It depends on who benefits from tax cuts. Provisional estimates suggest the biggest recipients of tax cuts will be the very wealthy. However, the very wealthy tend to have a lower marginal propensity to consume. Therefore, tax cuts for the rich will be mostly saved or invested in assets. If you want to boost consumer spending, it is better to target tax cuts at lower income rates.

Lawson Boom. These tax cuts have some parallels with the late 1980s in the UK. Income tax cuts of 1987/88 contributed to economic growth of 4%. But, this growth proved to be inflationary and short-lived.

Deficit spending can boost economic growth (at the right time)

In a recession, there is a very good case for allowing a larger budget deficit to provide fiscal stimulus at a time when private sector spending is low. See Expansionary fiscal policy.

Conclusion

An important factor is the state of the economy. WIth US growth close to 3%, there is no need for government to boost aggregate demand and consumer spending with tax cuts. A period of sustained growth is a time to reduce the budget deficit not increase them. A more productive use of government budget would be to invest in infrastructure bottlenecks – which would help increase productivity in long-term.