ECONOMIC GROWTH AND DEVELOPMENT Economic Growth implies the change in per capita income, while economic development means economic growth plus change. Change here may be welfare changes or distributional changes. Features of Modern Economic Growth; given by Kuznets:1. High rates of growth per capita product (10 times) and population (5 times).2. Rise in productivity3. High Rate of Structural Transformation: Shift away from agriculture to non-agricultural sectors.4. Increased urbanisationEconomic development :- features1. Process: Social (Control of population), technological (new technology) or economic forces (efficient use of resources). 2. Real National Income: Positive relationship between Real National Income and Economic development Stability of price is an essential condition for promoting development. 3. Long Period: Real National Income should continue to rise in Long run. Accelerates developmentAmartya Sen’s Concept of Development: He gave the concept in 1980s in his work “Development as Freedom”. According to him, development would mean if there is: 1. Capabilities to function: Entitlements give a right in the society, which further decides their capabilities to function. 2. Included freedom: Principal means of achieving development/ Removing un-freedoms like lack of political freedom, famine and under-nourishment) ❑ Dudley Seers, in his work “The Meaning of Development” (1969), took three indicators which would reflect whether development has occurred or not. The indicators are: 1. Unemployment 2. Poverty 3. Inequality →Decline in any of them would lead to developmentDenis Goulet introduced three core values of development in his work “The Cruel Choice: A New Concept in the Theory of Development” which are: 1. Life sustenance: Ability of a person to meet his basic needs, which can be in the form of reduction in absolute poverty, hunger, etc.2. Self-Esteem: Ability to be a person, that is, kind of things a person enjoys like self-esteem, dignity, etc. In other words, there should not be a feeling of inferiority complex.3. Freedom: Freedom from servitude, person should be free from miseries, exploitation, etc.Characteristics of an Under-Developed Economy:-1. General Poverty 2. Agriculture: Main occupation3. Dualistic economy 4. Under-developed natural resources5. Demographic features 6. Unemployment and disguised unemployment7. Economic backwardness 8. Lack of enterprise and initiative9. Insufficient capital equipment 10. Technological backwardness11. Foreign trade orientationSUSTAINABLE DEVELOPMENT Amartya Sen was the major contributor in the concept of Sustainable Development. The concept appeared in 1987 in “Our Common Future: The Brundtland Report”. Sustainable development: Meeting the needs of present generation without compromising the needs of future generation. Environmental Accounting: It was given by David Pearce and Jeremy Warfard. ❑ Environmental accounting is done using the formula: Total capital = Human capital + manufacturing capital + Environment Capital NNP = GNP – Dm – DnWhere: NNP = Net National Product; GNP = Gross National Product; Dm = Depreciation of manufacturing capital; Dn = Depreciation of environment capital NNP = GNP – Dm – Dn – A – R Where: A = Averting expenditure; R = Restoring Expenditure❑ To promote the concept of sustainable development, Ministry of Environment and Forests (MOEF) was set up in India in 1985. INDEX OF DEVELOPMENT 1. Gross National Product: Initially the change in gross national product was considered to be an indicator of development.Physical Quality of Life Index (PQLI): The PQLI index was given by Morris D. Morris in 1979. He used three indicators:a. Life Expectancy at age 1b. Infant Mortality: It is the number of deaths per 1000 live births. c. Literacy: It only considered general ability to read and write. The best was 100 and worst 0.❑ As a result, the value of the index ranges from 0 to 100 with 0 to be the worst scenario and 100 to be the best.PQLI = (Life Expectancy at age 1 + Infant Mortality + Literacy)/3Human Development Index (HDI): It was given by Amartya Sen and Mehboob-Ul-Haq in 1990 and was published by UNDP.Indicators in HDI are: a. Income or Standard of living: the proxy variable for this is real per capita income. b. Education/Knowledge Indicator: Two variables are used: • Adult Literacy: Weight attached to it is 2/3. • Gross Enrolment Ratio (Number of years of schooling): Weight attached to it is 1/3. c. Longevity/Health Index: The proxy variable used is life expectancy at age zero. HDI = 1/3 (Income + Education + Longevity) • HDI value ranges between zero and one where zero is considered to be the worst while one is considered to be the best. HDI value 0 to 0.499 Low Level of human development 0.5 to 0.799 Medium level of human development 0.8 to 1.0 High level of human developmentTHEORY OF BIG PUSH The theory of big push was given by Rosenstein Rodan in 1943 in his work “Problems of Industrialization of East and South-East Europe” • A firm will be influenced by what other firms are doing. • Probability of one firm will depend on how the firms are operating. • Co-ordination amongst firms is important. ❑ The theory talks about indivisibilities: External economies which will result from wide scale production and hence cheap raw materials and wide extent of markets. 1. Production indivisibilities: The theory states that initial capital requirements should be high. Greater level of output would result in decreased cost and thus capital-output ratio decreases. 2. Demand indivisibilities: It suggests that investment in a number of ventures at the same time would be profitable. The concept was widely publicized in Nurkse’s book namely “Problems of capital formation in Underdeveloped countries”3. Supply indivisibilities: Usage of savings should be in profitable ventures. 4. Psychological indivisibilities: The environment in which development takes place should be created so that people can adapt to that environment.❑ The theory also talks about complementarities, that is, interdependence. It implies that investment in one firm are dependent upon investments of other firms. Need for Big Push 1. Urbanisation effects 2. Infrastructure effects 3. Training effects 4. Inter-temporal effects : Avoid co-ordination failure CRITICAL MINIMUM EFFORT THESIS ❑ The theory is given by Harvey Leibenstein in his work “Economic Backwardness and Economic Growth” in 1957 and provides a strategy for development.❑ The theory suggests that to break the vicious circle of poverty, the economy should move to critical level in terms of investment. ❑ It is based on Malthusian theory of population which states that with increase in income, population will initially increase but will decrease at a later stage because of cost of bringing up the family. ❑ The theory talks about shocks (Income depressing factors) and stimulants (Income increasing factors). In case of under-developed economies, shocks is greater than stimulants. In case of developed economies, shocks are less than the stimulants. ❑ Initially in the process of development, shocks is greater than stimulants but after some time, due to institutional factors, the stimulants become greater than shocks. Stimulants in an economy depends upon: 1. Attitude of people and the motivation aspect. 2. Activities of the growth agents (innovators) 3. Creation of positive sum incentive (factors which change the attitudes of people and will help in increasing income)❑ Leibenstein talks about two types of incentives in the under-developed countries:1. Zero-sum incentives: these have zero effect on the economic growth. These incentives have a distributive effect2. Positive sum incentives: these promote and induce economic growth. These are important for development process because they bring a change in attitudes and aspirations of the people. ❑ Leibenstein gives an important role to the entrepreneur as a growth agent ❑ Need for Critical Minimum Effort are: 1. To overcome internal diseconomies2. For achieving balanced growth3. To overcome depressants like high death rate, etc4. To generate growth momentum Difficulties in achieving Critical Minimum Effort are 1. Lack of entrepreneurs 2. Limited investment opportunities 3. Deficiency of capitalTHEORIES OF DEVELOPMENT 1. Classical Theory of Development ❑ The theory is given by Adam Smith who is known as the Father of Political Economy and is the Founder of Classical School of Economics. Smith’s work is “An Enquiry into the Nature and Causes of the Wealth of Nations”. ❑ Capital accumulation is the central point of this theory around which the entire theory of development revolves. Thus, capital accumulation should be encouraged ❑ Promoted the concept of division of labor and specialization which would increase the productivity of workers. ❑ In favor of Laissez-Faire policy, that is, no government intervention. ❑ The classicals promoted the concept of invisible hand. 2. Ricardian Theory of Development Ricardo gave the theory of development in his book “Principles of Political Economy and Taxation” (1817). He gave the main role to the capitalists who accumulate capital from the profits which is the primary source of capital accumulation.❑ It is also considered to be the theory of distribution which determines the shares of different factors- land, labour and entrepreneur. ❑ Ricardo uses marginal principle and surplus principle, according to which first rent is determined. The remaining earning is divided into wages and profits. ❑ According to Ricardo, it is the productivity of land which determines the level of agricultural profit and it occupies the central place in the Ricardian system of development. ❑ Features of a stationary state are: 1. Profits tend to decline. 2. It is the state in which the rent increases and profits and wages decrease. 3. Profits become equal to zero and there is no capital accumulation. 4. Wages become equal to the subsistence level. 5. Stationary state arises due to increase in population and fixed supply of products. ❑ According to the theory, international trade provides opportunities for fresh investments and thus should be free from government interference.3. Marxian Theory of Development ❑ The theory of development was given in his book ‘Das Capital’ in 1867. ❑ The basis of this theory was that we move from a classless society to that with class. Historical Materialism: Marx introduced the concept of historical materialism stating that any change in the society will have its base in economic causes or policies. Movements in the society will be in the following stages: a. Primitive/Asiatic Society: Classless society. b. Slavery society c. Feudal society: There is a relationship between haves and have nots. d. Capitalists society Theory of class struggle: Clash of interest of two groups, that is;1) capitalist 2) working class. According to this theory, Total Capital = Constant Capital (C) + Variable Capital (V) + Surplus Value (S) Rate of Exploitation = S/VOrganic Composition of Capital (K):It is the amount of labour equipped with capital. K = C/V or C/C+V Increase in Technology →Decrease in Labour →Industrial Reserve Army →Doom of capitalism →Socialism Theory of Crisis: The theory of crisis is due to over production. The theory of crisis is characterized by: a. Falling rate of profit b. Unbalanced growth of different sectors Over Production →Labour Unemployment →Wages decrease →Reduced purchasing power ❑ Capitalists believe in capital accumulation which leads to under consumption and hence a glut in the economy4. Schumpeter Theory of Development ❑ Schumpeter’s ideas about economic development first appeared in his book “The Theory of Economic Development” in 1911. ❑ According to him, the development is a spontaneous and discontinuous change in the flow channels which causes a disturbance in equilibrium and hence alters and displaces the equilibrium state forever. ❑ In simple words, development is a process of creative destruction because development is the spontaneous change in something which is already existing. ❑ According to Schumpeter, development will happen only when circular flow is disturbed. The circular flow can only be disturbed through innovations or any new discoveries.The qualities must for an innovator are:1. He should have a technical know-how.2. Services of other factors.People will prefer to work as innovators because:• For their own joy.• For superiority• For wealth purposes❑ Primary wave of expansions (upswings) will be followed by secondary wave (downswings).❑ Creative destruction will start when the gestation period will get over.❑ Innovations are copied by others in the form of swarm like clusters.

QUESTIONS FOR CLARIFICATION

1. The term real is specified in the definition of economic development becauseA) GNP statistics are affected by changes in price level.B) GNP statistics are estimated each year in current rupee terms.C) Real GNP is a figure corrected for price changes and isolates growth in real or physical terms from the increases in priceD) None of the above.2. With economic growth there is A) a shift away from agriculture B) a shift away from manufacturingC) a shift in favour of agriculture D) a shift away from services.3. For economic development, Schumpeter gave importance toA) CreditorsB) natural resourceC) innovationD) none of the above4. The statement, the division of labour is limited by the extent of the market is given byA) Adam Smith B) J.B. say C) David Ricardo D) none of the above5. Ricardo predicted the economy ends in a stationary state becauseA) people would tire of workingB) the economy would run out of capitalC) innovation would dry upD) the economy would run out of arable landAnswers:-1) C 2) A 3) C 4)A 5) D

MODELS OF GROWTH 1. Harrod Domar Model: Harrod gave his model in 1939 and Domar in 1946-47. ❑ The main variables in their theory were Investment (I) and Savings (S). ❑ Besides this, they explored the dual nature (demand and supply) of Investment. Investment will create income and hence generate demand (demand effect). On the other hand, investment will add to the productive capacity of the economy and hence create supply of productive capital (supply effect). Harrod: “Deepening Aspect of Investment” (Each worker has more tools to work with.) Domar: “Widening Aspect of Investment” (Each worker has more pieces of equipment of the same type.) General Assumptions of the theory: a. Full employment b. No government interference c. Closed economy d. No lags in adjustment e. Average propensity to save (APS) = Marginal Propensity to Save (MPS)f. Propensity to save and capita coefficient are constant, that is, they follow constant returns to scale. g. Income, Investment and Savings are taken to be in the net sense. h. Savings and Investment are equal in ex-ante and ex-post sense. According to the Harrod Model, neutral technical progress was labour augmenting. Harrod gave three concepts of growth: 1. Actual Growth Rate (G): It implies growth rate of output in a period of time. G = Δ𝐲/ 𝐲 (or)G = 𝐒𝐚𝐯𝐢𝐧𝐠 𝐈𝐧𝐜𝐨𝐦𝐞 (𝐒) / 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐈𝐧𝐜𝐨𝐦𝐞 (𝐂) 2. Warranted Growth Rate (GW): It is the full capacity or potential growth rate which tells us the entrepreneurial equilibrium. GWCr = SWhere, Cr is the required capital to maintain warranted growth rate3. Natural Growth Rate (GN): It is the maximum growth rate or full employment that can be achieved. In other words, it is the maximum growth rate that can be supported by labour growth and technical progress. ❑ In case of Harrod Model, if G = GW which implies C = Cr. It is known as Knife Edge Equilibrium.If G < GW→ Supply > Demand; Deficiency of demand because they are not fully absorbed → Problem of Over Production → Stagnation or Depression If C > Cr → Actual Amount of Capital > Required Amount → MEC decreases in long run → Depression and Unemployment If G > GW → Growth rate of income > Growth rate of output → Demand > Supply → Inflation If C < Cr → Actual Amount of capital < required amount → Deficiency of capital leading to fall in production → Secular Inflation❑ Equilibrium is reached when G = GW = GN which is known as knife edge equilibrium when labour growth is considered. At this point, the equality is maintained between Growth Rate of Investment, Growth Rate of Income and Growth Rate of Labour.Domar Model❑ Domar used Kurihara’s equations. At full employment level, I/s = k. σwhere I = Investment and s = marginal propensity to save k = real capital stock and σ = productivity of capital I = k.σ.s (Condition for steady growth) Razor Edge Equilibrium and the condition to maintain steady growthΔI/I = σ.sIf ΔI/I > σ.s Leads to increase in purchasing power and hence Inflation If ΔI/I < σ.s Leads to over-production and thus Depression 2. Meade Model: It is also known as Steady Growth rate model. Given in his work “A Neo-Classical Theory of Economic Growth” in 1961. Important Assumptions:1. No government interference. 2. Machinery is the only form of capital. 3. Perfect substitution between consumption and capital goods. 4. Prices are not changing. 5. Considered depreciation of capital because of which capital will be replaced. 6. Perfect CompetitionQ = F (K, L, N, t) Where: Q = Output; K = Capital; L = Labour; N = Land (constant); t = technology (constant technical progress) Δy = vΔK + wΔL + Δy’ Where: v = Capital productivity; w = Labour productivity; Δy’ = rate of change in output because of technical progress. y = uk + Ql + r ❑ Per capita changes would be depicted by y-l; where l is the labour growth.Steady growth conditions: a. Elasticity of substitution between all factors is unity. b. Population growth is constant. c. Proportion of wages, rents and profits saved are the same. d. Neutral technical progress for all factorsSteady State = Δ𝒚/𝒚 = Δ𝑲/𝒌Critical rate of Capital accumulation: a = 𝑸𝒍+𝒓 / 𝟏−𝒖STRUCTURAL TRANSFORMATION MODELS1. Lewis Theory of Development: The theory was given by Arthur Lewis in 1954. ❑ It is also known as the “Model of Unlimited Supply of Labor”. The theory provides solution to the excess labor supply in the developing nations. ❑ The theory states that with the movement of labor from rural to urban sector, the traditional society transforms into the modern society.❑ The theory assumes a dual economy, that is, co-existence of 1. Agriculture/ Subsistence/ Traditional sector and2. Industrial/Manufacturing/Modern sector. ❑ According to the theory, Development in an economy takes place due to transfer of labor from agriculture to industrial sector. As a result of movement of labor from traditional to modern sector, the capital in the latter accumulates and output expands, thus leading the economy towards development. ❑ The theory also assumes that supply curve of labor is perfectly elastic at minimum wage rate till the point the entire surplus labor is not fully absorbed in the economy. ❑ According to the theory, the number of workers in rural sector are more as compared to that in the industrial sector. So the transfer of labor would take place from rural to urban areas.❑ No capital accumulation in the agriculture sector❑ Growth in industrial sector is self-sustaining because it absorbs the entire surplus labor.

❑ In the agriculture sector, the maximum labour which can be absorbed is equal to LA. At that point of employment, the total product is maximum and corresponding to that the marginal product of Labour is equal to zero. The wages paid in the agriculture sector is equal to WA. The labour beyond LA point, is the surplus labour which is then absorbed in the manufacturing sector❑ In the manufacturing sector, the labour is paid a wage which is higher than the wages paid in the agricultural sector (WM and is fixed). So when L1 labour produces TPM(KM1) output, wages paid are WM and there is surplus left. That surplus is then re-invested which shifts the total product curve upwards. The process continues till all the surplus labour is absorbed in the agricultural sector.2. Fei-Ranis Model: Given in 1964 in their work “Development of the Labour Surplus Economy”. ❑ It is an improvement over Lewis Model. Even this model assumes co-existence of a dual economy, that is, agriculture and industrial economies.Assumptions of the theory are;1. Labor moves from rural to urban sector through the process of development. 2. The economy experiences diminishing returns to a factor. 3. Output in agriculture is a function of land and labor. On the other hand, output in manufacturing sector is a function of labor and capital. 4. Surplus of agriculture sector finances the development of industrial sector. 5. Wages in agriculture sector are at a subsistence level, that is, they are at a constant institutional wage rate. 6. Supply of labor is perfectly elastic. 7. Marginal product of excess labor is zero. Profits and Hidden rural savings are reinvested →Increase in Capital Accumulation →Profits increase →Wages increase →Labour supply increases till the point surplus labour is absorbed.3. Harris-Todaro Model of Migration Harris gave his model in 1970 and Todaro gave his model in 1969. ❑ The model came in reaction to the Lewis Model. According to it, any labor migrated from rural sector may remain unemployed even after going to urban sector. This view was completely against the Lewis Model. The following assumptions were taken into consideration: 1. Migration is entirely an economic phenomenon. 2. Migration to urban areas is in excess of urban jobs. Growth rate is both likely and possible so that the labor which has migrated may remain either unemployed or underemployed in the informal sector. 3. Migration decision is influenced by the expected urban rural income differentials rather than the actual differentials. Decision of migration is financially and psychologically made. 4. Migrants want to maximize their expected gains from migrations. 5. The possibility of getting an urban job varies directly with employment rate in the urban areas❑ At the subsistence level of wages (WA* and WM*), all the labour is employed in both the sectors. Manufacturing sector then sets an institutionally determined wage rate, that is, ̅𝑊̅𝑀̅. Therefore, the labour employed in manufacturing sector now decreases and reached LM. At that point, if we assume full employment, the wages in agricultural sector would reduce to WA** because labour supply has increases in that sector and hence the wages have decreased. The decision of migrating will depend upon: WA = 𝑳𝑴/ 𝑳𝑼𝑷 ∗ ̅𝑾̅̅̅̅̅̅̅MWA = Wages in agriculture, LM = Labour in manufacturing sector, ̅𝑊̅𝑀̅ = Institutional wages in manufacturing sector, LUP = Labour in urban pool with or without the employment

❑ According to the Todaro Model, Migration can be initiated when wages in manufacturing sector are set at a higher level.Agricultural productivity becomes low →Marginal productivity decreases →Wages decrease →Incentive to migrateAccording the Model, The number of labor in manufacturing sector can be controlled by:1. Increase the labour productivity in agricultural sector.2. Focus on labour intensive industries.3. Education4. Minimizing the factor price distortions.

QUESTIONS FOR CLARIFICATION

1. . Dualistic economy is one whereA. Agricultural and industrial sectors are equally developedB. A modern industrial sector exists side by side with the traditional subsistence sector.C. Public and private sectors exist side by sideD. Indigenous industries are developed in collaboration with foreign companies.2. The condition of steady growth, in terms of rate, in Harrod growth model isA. Actual Growth Rate= Warranted Growth rateB. Actual Growth rate = take-off Growth RateC. Actual Growth rate = National Growth RateD. Warranted Growth Rate = Natural Growth Rate.3. Harrod-Domar models of economic growth are based on the experiences of A. Underdeveloped economies B. Developing economicsC. Advanced capitalist economies D. Socialist economies4. The term “golden age as used by Joan Robinson refers toA. Primitive economiesB. The situation of smooth and steady growth with full employmentC. The economy which uses gold coinsD. All the above5. Disguised unemployment generally means A. Alternative unemployment is not available B. Large number of people remain unemployed.C. Marginal productivity of labour is zero D. Production of workers is low.6. Who advocated the view that vicious circle of poverty on the demand side of capital formation can be broken through the technique of balanced growth?A. A.O. Hirschman B. R. NurkseC. W.W. Rostow D. H. Libenstein7. In the Lewis’ theory capitalist surplus results because the marginal productivity of labour in the capitalist sector is A. Higher than the capitalist wage B. Ever increasing C. Positive D. Higher than that in the subsistence sectorAnswers:-1) B 2) A 3) C 4) B 5) C 6) B 7) D

Balanced Growth Theory: The theory of balanced growth was promoted by Ragnar Nurkse, Lewis, Allen Young, Rodan. ❑ According to the balanced growth theory, all sectors should grow together. The investments should be made simultaneously in all the sectors. ❑ Moreover, the state intervention is required and hence more requirement of capital. The theory focuses on creating social overhead capital which would further generate economies of scale. Big Push Theory: By Rosenstein Rodan: Planning industrialization and balance in supply approachVicious Circle of Poverty: By R. Nurkse: Breaking of vicious cycle of poverty by application of capital to wide range of industriesLewis Theory of Development: Balance between agriculture and industries, material and human capital, export and import, etc.❑ The following are the requirements for any economy to follow the path of balanced growth:1. More Capital 2. State intervention 3. Formulation of plans4. Co-ordination and co-operation between different sectors of the economy.Unbalanced Growth ❑ The theory was first propounded by Hirschman in his work “The Strategy of Economic Development” (1958). Other proponents of the theory were H.W. Singer, Paul Streeton, R. Rostow, Kindleberger. ❑ The theory focused upon deliberately creating imbalance between the sectors of an economy. Investment should be made in leading sectors which will further create economies for other sectors ❑ Focused on two types of series:Convergent Series1) Source of Investment is from private enterprises. They appropriate more economies than they create.2) It is not beneficial from the social point of view.Divergent Series 1) They create more economies.2) Source of investment is from the public domain. 3) It is beneficial from the social point of view. ❑ Unbalanced growth theory talked about two strategies which are as follows: 1) Social overhead capital to Directly Productive Activities: Social Overhead activities are the basic services given to primary, secondary and tertiary sectors. Therefore, they are known as “Pressure Relieving Investment”2) Directly Productive Activities to Social Overhead Capital: These are “Pressure Creating Investment”. The productive activities have an incentive to improve the social overhead capital to generate economies of scale. ❑ It is a better strategy for under-developed economies, due to shortage of capital in those nations. ❑ The theory involves a linkage effect as one sector generates development process in other sectors.❑ Creation of economies and is thus known as “Powerhouse for generation of external economies”.

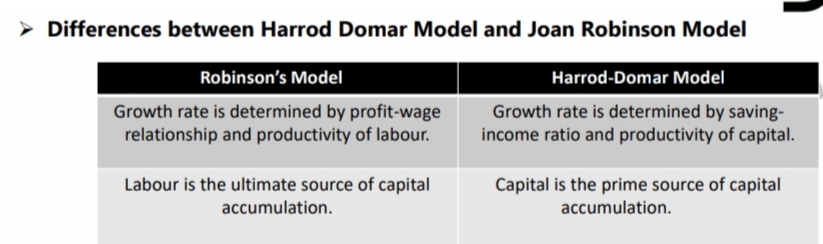

Prebisch-Singer Thesis The theory was given in 1950s and it highlights the negative impact of trade. The theory divides the world into two parts: 1. The centre: It is a group of developed nations. 2. The Periphery: It is a group of under-developed nations.𝐓𝐞𝐫𝐦𝐬 𝐨𝐟 𝐭𝐫𝐚𝐝𝐞 = 𝐏𝐫𝐢𝐜𝐞 𝐨𝐟 𝐞𝐱𝐩𝐨𝐫𝐭𝐞𝐝 𝐠𝐨𝐨𝐝 / 𝐏𝐫𝐢𝐜𝐞 𝐨𝐟 𝐢𝐦𝐩𝐨𝐫𝐭𝐞𝐝 𝐠𝐨𝐨𝐝The developing countries do not benefit from trade because they produce primary goods. As a result, the resources would be transferred from developing to developed nations through trade, hence deteriorating the economic conditions of the periphery. Cumulative Causation Theory The theory was given by Myrdal on the basis of backwash effects and spread effects. Myrdal assumes a type of multiplier-accelerator mechanism producing increasing returns in the favored region. ❑ The economy experiences two kinds of effects 1. Backwash Effect: Negative effects from development in one area to another2. Spread Effects: These are positive externalities. The development in one area initiates development in surrounding area.❑ It is also stated that the developing nations do not develop because in case of them the backwash effects are greater than spread effectsLow Level Equilibrium Trap The theory was given by R. Nelson in his work “Theory of Low Level Equilibrium Trap” in 1956. The theory is based on the Malthusian Theory of Population. ❑ According to this, Per capita Income increases more than subsistence level→ Population increases ❑ However, population and per capita income are positively related only till some point, beyond which rise in per capita income won’t have much effect on the population levels. ❑ According to the theory, the economies facing a low level equilibrium trap will also experience a situation of ‘slack’. By slack it means that those economies will not be able to achieve maximum possible rate of growth. Growth rate of capital (dk/k) comes from:1. Addition to capital stock2. Land brought under cultivation.❑ Land is positively related to population and negatively related with land already under cultivation.Per capita income changes due to:1. Rate of growth of population (dP/P = f(Y/P)) where P is the population.2. Rate of growth of income (dY/Y= f(Y/P)) where Y is the income.❑ With the increase in per capita income above the minimum subsistence level, the population tends to increase. ❑ However, when the growth rate of population reaches an upper physical limit, it starts declining with further increase in the per capita income.Reasons for low level equilibrium trap are as follows:1. Inefficient production processes.2. Correlation between per capita income and population.3. Slack4. Social structure of the economy.Vicious Circle of Poverty ❑ The theory was propounded by Nurkse, Gunar Myrdal. Nurkse gave the theory in his work namely “Problem of Capital Formation in Under developed countries” in 1953. ❑ According to the theory, a country is poor because it is poor. The theory focused on the supply of capital, stating that the inducement to invest is limited by capital. Supply of Capital = f(Willingness to save, ability to save) Demand for Capital = f(Inducement to invest) ❑ The theory was explained from both the demand as well as supply side. Supply side: Low Income→ Low Savings→ Low Investments→ Low Capital Formations→ Low Productivity. This will continue as a circleDemand Side: Low Income→ Low demand, hence Small Market→ Low Inducement to invest→ Low Capital→ Low Productivity. This will continue as a circleModel of Capital Accumulation / Golden Age Model❑ The model was given by Mrs. Joan Robinson in 1963. ❑ She used the Marx’ concept of Expanded Reproduction Schema; Keynes’ Income theory (Inflationary gap, effective demand, hoarding), Harrod’s concept of Balanced Growth and Neutral technical progress. ❑ Besides this, she also used Kalecki’s saving function that states capitalists save all and workers spend all.➢ The focus of this theory is on Capital accumulation and profit maximization.❑ Important Assumptions are:-1. Entire income is divided into wages and profits.2. Wage earners consume everything and do not save. Profit earners will invest everything and consume nothing.3. Neutral technical progress. 4. Fixed technical coefficient 5. Prices are not changing6. Elements of monopoly power encourage saving through their influence on income distributed.❑ Main idea of the theory was that rate of capital accumulation and rate of profits are to be brought in equilibrium.y = wL + ΠKwhere y = income, w = wages, L = labour Π = rate of profit, K = capital❑ Golden Age: Robinson also gave the concept of golden age. Under the golden age, we consider the labour growth rate, capital growth rate and rate of profits. The golden age is achieved when the equality is maintained between all the three variables, that is,ΔK/K = ΔL/L = ΔΠ❑ The theory realised Potential growth rate. Potential growth rate is the maximum rate of capital accumulation which can be maintained and achieved at constant profit rate. Limping Golden Age: Rate of capital accumulation is well below full employment level, which would lead to unemployment.Leaden Golden Age: It is a situation of mass unemployment and there is a fall in the standard of living.Restrained Golden Age: Under this, the desired rate of accumulation is not achieved because output per worker doesn’t support it.Bastard Golden Age: According to this, the desired rate of accumulation is not achieved because of rise in prices, that is, inflation.Platinum Age❑ Under the platinum age, the initial rate of investment/consumption is not suitable for desired rate of growth to take place.➢ Similarity between Harrod Domar Model and Joan Robinson Model are:1. Both the theories postulate fixed capital coefficient and technical neutrality. 2. According to both the theories, there is no automatic mechanism by which adjustment could be brought about between natural growth rate and warranted growth rate. 3. Knife-edge equilibrium is inherent in both the models.

SOLOW MODEL The model was given by Solow in 1956 in his work “A Contribution to the Theory of Economic Growth” and is also known as Exogenous Growth Model or Neo Classical Growth Model.❑ Under this, the technical progress and population growth rate are treated to be exogenous in nature.❑ It is different from Harrod-Domar Model in the following ways: 1. Harrod-Domar Model states fixed technical coefficient and Solow Model assumes variable technical coefficient. 2. Under Harrod-Domar Model, there is a tendency of divergence from equilibrium while in case of Solow Model, there is a tendency of convergence towards the equilibrium. ➢ Important Assumptions are:-1. Single good is being produced. 2. There are two factors of production: Labour and Capital 3. Labour and Capital are substitutable. 4. Labour is paid a wage as per their marginal product. 5. Variable technical coefficient 6. Flexible price, and follows an interest-wage system. 7. Assumes constant returns to scale. 8. Production function is homogenous of degree 1. 9. There is a dual economy, that is, agriculture sector and industrial sector.❑ According to the theory, any Capital- Labour Ratio (K/L) will move towards the equilibrium.❑ r = K/L, r’ = Δ(K/L)➢ If r’ = r Equilibrium K/LRate of growth of capital = rate of growth of labour ➢ If r’ < r Labour is growing at a faster rate than capital Equilibrium K/L is less than the actual K/L ➢ If r’ > r Labour growth us slower than the capital growth. Equilibrium K/L is more than the actual K/L

QUESTIONS FOR CLARIFICATIONS

1. The concept of balanced growth implies a. Balanced growth of exports and importsb. the balanced growth of public and private sectors.c. the balanced growth of the industry and agriculture along.d. all-round and harmonious development of the various sectors of the economy2. According to Ragnar Nurkse larger population size in India leads toa. a larger saving potentialb. leaves saving potentialc. a smaller saving potentiald. a heavy external migration3. Nurkse says-in the context of an underdeveloped country, inducement to invest is limited bya. lack of investment opportunities b. lack of savings.c. the size of the market d. the policy of the Government.4. Beside poverty, developing economies have many other common characteristics likea. percentage of their population engaged in agriculture is generally very highb. technological dualism prevailsc. the marginal product of labour is close to zero in less developed countriesd. All of the above5. According to Lewis theory, the supply of labour at the existing capitalist wage isa. perfectly elastic b. perfectly inelasticc. relatively elastic d. relatively inelastic6. Fei-Ranis theory of economic development is based ona. balanced growth during the take off processb. importance of agricultural products in capital accumulation in under developed countries c. Dualistic approach to developmentd. all of the above7. The Critical Minimum effort theory is put forth bya. H. Leibenstein b. Rosenstein Rodanc. W.A. Lewis d. J.H. BoekeAnswers:-1) d 2) a 3) a 4) d 5) a 6) d 7) a

KALDOR’S MODEL ❑ The model was given in 1957. It relates technical progress with capital accumulation. ❑ Kaldor gave importance to non-economic factors also in the development process. He followed the Keynesian’s theory and Harrod’s analysis. ❑ He divided the society into two sections: Labour and Capitalists. Entire income is divided into wages and profits. Wages include the income of the marginal labour while profits include the income of the capitalists, entrepreneurs and property owners. ➢ According to Kaldor, Total Savings = Savings out of wages + Savings out of profits.❑ This model assumes that Marginal propensity to consume for workers is more than the marginal propensity to consume for capitalists. ➢ Kaldor gave the theory in two respects: Firstly, when population remains constant. Secondly, when population is expanding1. Constant Population ❑ Under this, Proportionate growth rate of income or output = Proportionate growth rate of output per head.➢ Conditions to achieve stable equilibrium 1. Savings > Investment 2. Pt ≤ yt – w3. Pt > minimum profit margin for investment to continueWhere Pt= Profits, Yt= Income2. Expanding Population➢ Under this, the proportionate growth rate of income or output is the sum total of proportion of output per head and proportionate change in the working population.➢ We assume that the population is an increasing function of increase in income up to a certain point after which the population is stagnant.ENDOGENOUS GROWTH MODELS❑ Endogenous growth models, also known as New Growth Theory, treat technical progress to be endogenous in nature. They also assume that similar technical conditions are not available to all countries.❑ These theories consider the spillover effects or externalities of investment in technology. Moreover, they do not assume constant returns to scale to be a necessary condition. According to them, increasing returns to scale is also possible.1. Romer’s ModelThe model is also known as Learning by Investment and was given in 1986.❑ According to Romer’s Model, creation of knowledge is a sub-product of Investment. Knowledge is considered to be a non-rival good. The model also considers the possibility of externalities, that is, returns to investment help in creating more knowledge. However, it is quite possible that knowledge may show decreasing returns.❑ The focus of the theory was on Research & Development which helps in creating more knowledge.Features of knowledge:1. Sub-product of Investment 2. Non-rival good 3. Knowledge may show decreasing returns.Assumptions of the theorya. Growth is derived from a firm/industry.b. Industry produces under constant returns.c. The model assumes a Cobb-Douglous type of production function.d. Assumes a steady state of growth, that is, 𝐝𝐲/ 𝐝𝐭 = 𝐝𝐊 /𝐝𝐭e. Labour is allocated for two purposes: i) For current production ii) For creation of knowledge 2. Lucas Model ❑ The Lucas Model was given in 1948. The theory focused upon investment in human capital. According to the theory, growth rate is defined as: g= Growth rate of labour + Growth rate of per capital Investment in human capital3. Arrow’s Learning by Doing ➢ The theory focused upon how you gain by learning by doing which helps in decreasing the average cost. In other words, a firm, over time, learns to produce more efficiently and increases its stock of knowledge. Workers become more familiar with the work as volume of output increases. TECHNICAL PROGRESS ❑ By technical progress we mean inventing a new technology and improving it through innovation and diffusion in the society 1) Neutral Technical Progress: Produce more of output with increase in capital and labour in the same proportion, that is, keeping K/L ratio the same. 2) Capital Saving technical progress: Same amount of output can be produced with lesser amount of capital 3) Labour saving technical progress: Same amount of output can be produced with lesser amount of labour➢ Hicks’ Neutral technical Progress: Under this, efficiency of all factors increases in the same proportion and the ratio of marginal productivities of the factors, that is, MPK/MPL is constant for a given K/L ratio. ➢ Harrod’s Neutral Technical Progress: Harrod’s Neutral Technical Progress is labour augmenting, that is, the labour efficiency improves. As a result, marginal productivity of labour (MPL) increases with a given constant K/L ratio. Relative input shares remain the same for a given capital-output (K/O) ratio. ➢ Solow’s Neutral Technical Progress: It is capital augmenting. As a result, marginal productivity of capital (MPK) will increase with a given K/L ratio. Relative input shares remain the same for a given labour-output (L/O) ratioDEPENDANCY MODEL Neo-Colonial Dependence Model: It is an extension of Marxian analysis. According to the model, the dependence relationship between developed and developing nations will occur due to inequalities between them. False-Paradigm Model: According to the model, the dependency is a result of incorrect framework of development which is followed by the developing nations. In other words, experts provide incorrect framework to the developing nations. Dualism: Dualism states the co-existence of two separate worlds. There is a chronic difference between the two worlds which tends to increase over time. Developed nations do not help the developing counterparts.Types of Dualism1. Social Dualism By H. Boeke: Existence of East & West together 2. Technological Dualism By Higgins: Different techniques of production: Labour or capital intensive in different parts of the world3. Ecological Dualism: Difference in the endowments of the natural resources 4. Financial Dualism By HL Myint: Unequal access to financial credit Rostow’s Stages of Economic Growth: ➢ It was given in 1960. The theory talks about five stages of economic growth: Stage 1: Traditional Stage: The output per head is very low and tends not to riseStage 2: Pre-conditions to take-off/Preparatory Stage: changes in 1) society’s attitude towards science, risk taking, etc. 2) Adaptability of labour force, 3) political sovereignty, 4) development of financial institutions Stage 3: Take off stage: Rate of investment increases, and thus the real output increases. There is a rise in per capita outputStage 4: Drive to Maturity: less reliance on imports. It is a stage of increasing sophistication of the economyStage 5: Stage of Mass Consumption and Production: Affluent population, availability of durable and sophisticated consumer goods, hi-tech industries, etc.➢ According to Rostow, Development depends on six propensities: 1. Propensity to develop fundamental sciences. 2. Propensity to apply sciences to economic needs. 5. Propensity to accept innovations. 3. Propensity to seek material advance. 6. Propensity to consume 4. Propensity to have children Two-Gap Model: The model was given by Chenery and Strout in 1966. ➢ The basis of the theory is Harrod-Domar Model. ➢ The theory aims to calculate the amount of foreign aid required to overcome two constraints: 1. Saving-Investment Gap 2. Foreign Exchange GapE – Y = I – S = M – X = F Where: E = National Expenditure; Y = National Income; I = Investment;S = Savings; M = Import; X = Export; F = Net Capital Income ➢ The theory suggests that to fill the gap we need the external or foreign aid. In other words, I – S = M – X (in the ex-post sense) TECHNIQUES OF PLANNING ❑ Physical Planning: It refers to physical allocation of resources. Under this, we compute the investment coefficient. ❑ Financial Planning: The planning is usually done in monetary terms, that is, it estimates the size of investment in money terms. ❑ Planning by Investment/Indicative Planning: System is free from any restrictions, but there are still some controls and regulations. ❑ Planning by Direction: The central authority directs to achieve the goalsHISTORY OF PLANNING IN INDIA ➢ M. Visvesvaraya’s Book: “Planned Economy for India” ➢ 1937: National Planning Committee Chairman: Pt. Jawaharlal Nehru: Report Submitted: 1948 ➢ 1943: “A Plan for Economic Development in India” or “Bombay Plan” Eight Bombay Industrialists Aimed to increase per capita income by 100% in 15 years by increasing agricultural production by 130% and by increasing industrial output by 500%. ➢ 1943 People’s Plan (M.N. Roy) ➢ 1944 Department of Planning and Development was established. ➢ 1950 Planning Commission was established Highest priority to agriculture and consumer goods industries ➢ January 1, 2015 NITI Aayog (National Institute for Transforming India) Replaced Planning Commission, Involved states in Economic PolicyINVESTMENT CRITERIA Capital Turnover Criteria/Rate of turnover criteria/Marginal rate of return criteria: ❑ The theory was given by J.J. Polak and Buchanan. It states that the capital output ratio should be minimum. The investments should be in the projects where minimum capital resources are used to produce maximum output. Social Marginal Productivity Criteria (SMV Criteria):❑ The theory was given by Kahn & Chenery. According to the theory, capital should be used till the time marginal productivity of capital is equalized in all the uses.Reinvestment Criteria/Marginal Per Capita Reinvestment Quotient: ❑ The theory was given by Galenson and Leibenstein. The theory focuses on future growth and hence measure the extent to which we can save for future use.Net Present Value Criteria: ❑ To get the net present value, we deduct the cost from the present value. The main objective of our investment should be to maximise the present value.Time Series Criterion: ❑ Given by A.K. Sen. The main objective is to maximize output within a given period of time.

QUESTIONS FOR CLARIFICATION

1. Which of the following has not been advocated by A.O. Hirschmana. Unbalancing the economy with directly productive activities i.e. development via excess capacity of social overhead capitalb. unbalancing the economy with directly productive activities i.e., development via shortage of social overhead capitalc. Encourage industries with high combined linkage d. Simultaneous investment in all sectors in the economy.2. According to Lewis’ theory the subsistence wages at which the surplus labour is available for employment in the capitalist sector is a. Less than the wage rage in the subsistence sectorb. less than the average product of the workers in the subsistence sectorc. Cannot be less than the average product of the workers in the subsistence sectord. None of the above3. The basic difference between investing in social overhead capital and in directly productive activities is that a. the former creates external economies and the later appropriates these economiesb. the later creates external economies and the former appropriates these economiesc. the former creates only internal economies and later only external economiesd. the former must be in public sector and the later in private sector4. The occupational distribution of labour isa. only a shade different in developed and underdeveloped countriesb. different in developed and under developed countriesc. the same in developed and developing countriesd. nothing can be said5. The phrase demonstration effect was coined bya. J.K. Galbraith b. J.M. Keynesc. James Dussenberry d. Joan Robinson6. In Rostow’s theory the drive to maturitya. starts the development processb. completes the development processc. comes before the take-offd. follows the take-off7. The first Five Year plan of India was based on which modela. Harrod-Domar b. Mahalanobis c. Raj and Sen’s d. Freidman’s8. When the planning authority formulates the central plan, fixes objectives, targets and priorities for every sector of the economy, the system of planning is known asa. Physical b. financial c. centralized d. decentralized9. Deficit financing meansa. relying on foreign aidb. spending by borrowing from abordc. not spending enough to ensure developmentd. spending in excess of the available revenuesAnswers:-1) D 2) C 3) A 4) C 5) C 6) A 7) A 8) D 9) D

There were some confusions regarding the answers given in the last material,

1. Qstn No. 4- The question is regarding occupational labour. The questions itself is contradictory. But here, the answer given is the best one because most of the theories in development which focuses on the developing and under developed countries suggest that majority of the people engaging in the primary sector in both the developing and under developed countries. The occupational labour will be same in this regards. So the answer will remain the same.

2. Qstn No. 6- The answer key went wrong here. According to the Theory of Rostow, Drive to maturity follows take off stage.. sorry for the inconvenience caused.

3. Question No. 8- This also some what contradictory over two options given in this question, Centralised and Decentralised planning. Here, the definition is not complete for both the centralised and decentralised type of planning.

Centralised Planning: The framing, adopting, executing supervising and controlling the plan is done by central planning authority. Planning authority determines targets and priorities. It is the duty of the planning authority to bring harmony in the planning process. This type of planning comes from the top to the bottom. This plan determines the equality and cohesion. The central planning authority which determines the basic policies in view of the regional and local needs.

Decentralised Planning: Under this planning, responsibility lies with local and regional officials who take economic decisions about the plan. In other words, this planning starts from the grass roots. In other words, this type of planning is from bottom to top. Under this, plan is framed by the central planning authority by consulting different administrative units of the country.

In this regard, we can go for the answer C. That is, Centralised Planning