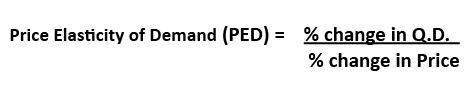

Price elasticity of demand (PED) measures the responsiveness of demand after a change in price.

Example of PED

- If price increases by 10% and demand for CDs fell by 20%

- Then PED = -20/10 = -2.0

- If the price of petrol increased from 130p to 140p and demand fell from 10,000 units to 9,900

- % change in Q.D = (-100/10,000) *100 = – 1%

- % change in price 10/130 ) * 100= 7.7%

- Therefore PED = – 1/7.7 = -0.13

If you need help calculating a percentage, see: How to calculate a percentage

- If price increase from £50 to £55 and PED was 0.5 How much did quantity demanded fall?

- 0.5 = % change in QD

- Therefore % QD = -5

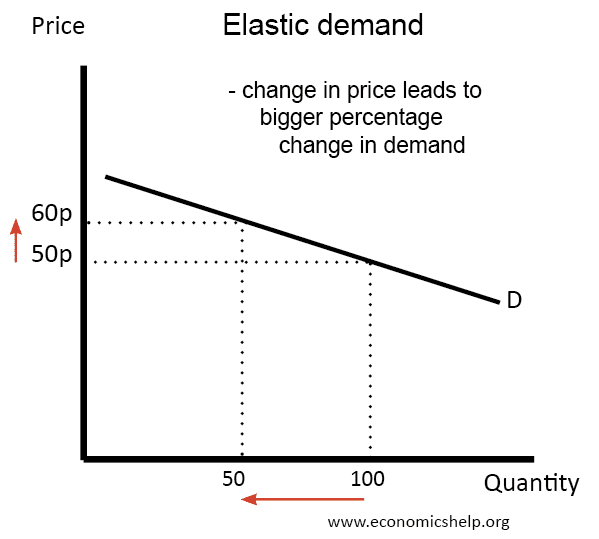

Price Elastic Demand

Definition: Demand is price elastic if a change in price leads to a bigger % change in demand; therefore the PED will, therefore, be greater than 1.

Goods which are elastic, tend to have some or all of the following characteristics.

- They are luxury goods, e.g. sports cars

- They are expensive and a big % of income e.g. sports cars and holidays

- Goods with many substitutes and a very competitive market. E.g. if Sainsbury’s put up the price of its bread there are many alternatives, so people would be price sensitive.

- Bought frequently

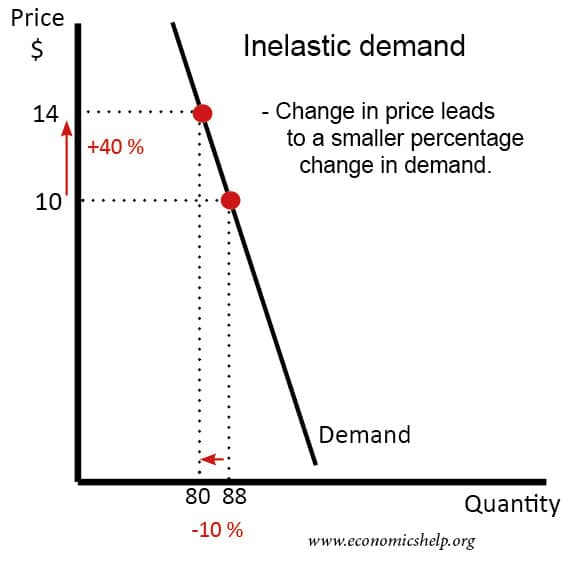

Price Inelastic Demand

These are goods where a change in price leads to a smaller % change in demand; therefore PED <1 e.g. – 0.5

- Inelastic demand PED <1 – Perfectly inelastic PED =0

Goods which are inelastic tend to have some or all of the following features:

- They have few or no close substitutes, e.g. petrol, cigarettes.

- They are necessities, e.g. if you have a car, you need to keep buying petrol, even if price of petrol increases

- They are addictive, e.g. cigarettes.

- They cost a small % of income or are bought infrequently.

- In the short term, demand is usually more inelastic because it takes time to find alternatives

- If the price of chocolate increased demand would be inelastic because there are no alternatives, however, if the price of Mars increased there are close substitutes in the form of other chocolate, therefore, demand will be more elastic.

Using Knowledge of Elasticity

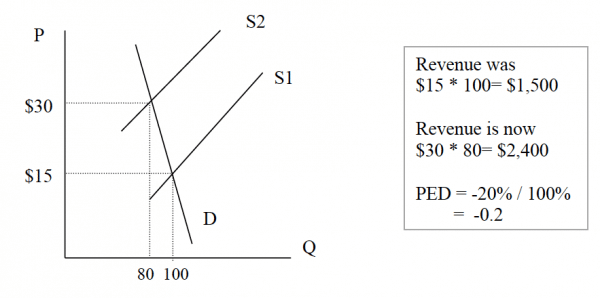

1. If demand is inelastic then increasing the price can lead to an increase in revenue. This is why OPEC try to increase the price of oil.

Graph showing increase in Revenue following increase in price

2. If demand is elastic, firms would be unlikely to increase revenue as this could lead to a fall in revenue. Instead, they could try advertising to increase brand loyalty and make demand more inelastic

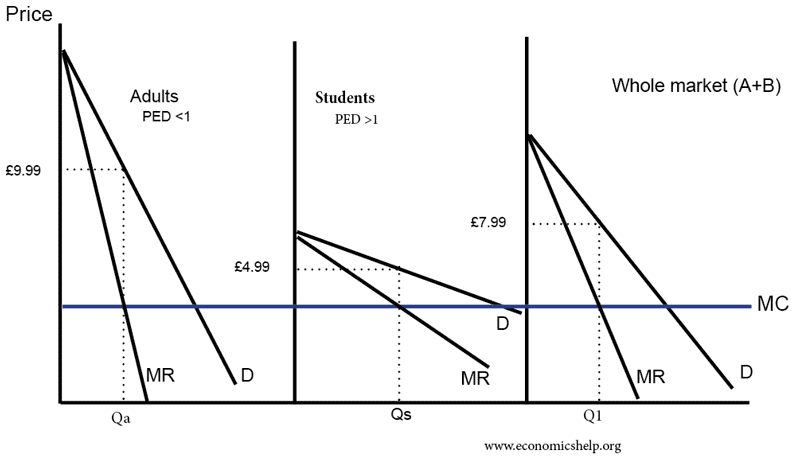

3. Price Discrimination. Some people pay higher prices for tickets for trains because their demand is more inelastic.

Adults (with more inelastic demand) face higher prices. Students with more elastic demand get lower price.

4. Tax incidence. If demand is price inelastic, then a higher tax will lead to higher prices for consumers (e.g. tobacco tax). The tax incidence will mainly be borne by consumers. If demand is price elastic, firms will face a bigger burden, and consumers will have a lower tax burden.