Do you live indoors? Use transportation powered by gasoline? How about buy food, you do that right? And not to get awkward or anything, but you do wear clothes from time to time, right . . . right?

Do you live indoors? Use transportation powered by gasoline? How about buy food, you do that right? And not to get awkward or anything, but you do wear clothes from time to time, right . . . right?

Presumably the answer to these questions is yes. If you partake in any sort of interaction with modern civilization you are constantly acquiring goods and services in exchange for some medium, a medium we call money. Money provides a way for us to acquire what we want from others without engaging in violence or coercion. It enables two strangers who have no reason to trust each other to efficiently, often almost instantaneously, work out a deal that benefits each other and then separate and go about their day.

But what is money? Where does it come from, and who decides how it is distributed? These questions strike at the core of society. Whatever position your government and context take towards the nature of economics has incredible impact on your daily life and whether your goals come to fruition. Consequently, the study of economics in recent times is both very important and controversial.

But studying economics can be difficult due to the overwhelming changes the subject has undergone. In 1900 we were living under the classical gold standard and enjoying perhaps the greatest period of economic development the world had ever seen. But after the world bludgeoned prosperity in the Great War, much of the previous era’s stability came crashing down. Whatever was left of the international gold standard was drowned in blood a second time during World War II, and since then the world has slowly transitioned from a commodity-backed monetary system tied to the U.S. dollar to a multinational central bank backed system.

What this means is that even the rules of the economic game have radically changed. Several generations ago debt was bad and banks were never to be trusted. Now, avoiding a mortgage and student loans is considered irresponsible. Thirty to forty years ago central bankers saw price stability as the mandate behind their existence. Now they have a dual mandate which also includes full employment.

Most economists will love some of the names on this list and hate others. But regardless of whether you think a particular thinker included here was brilliant or foolish, noble or wicked, you are living with the consequences of their actions. Hopefully understanding this will help us all build a brighter future.

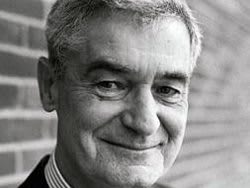

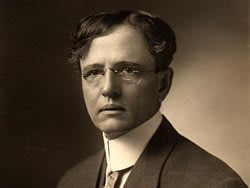

1John Maynard Keynes (1882-1946)

The flow of history is a river that most ride, but every so often a man, through sheer brilliance or force of will, builds a dam and redirects the course of civilization. John Maynard Keynes was such a man. As the most influential economist since 1900, some would argue in history, Keynes’ influence is difficult to overstate. He was the son of a successful economist and trafficked in the circles of the intellectual elite from his youth. He would become the leading figure in economics at Cambridge at a time when Cambridge became the leading center of economic study in the world.

It is difficult to appreciate Keynes’ impact until one compares what economics was like before him with what exists today. Before Keynes the world used the relatively simple gold standard. Money had a straightforward definition, namely it equaled a certain weight, and economics followed certain basic, common sense principles. Everyone knew that saving money was a good thing, and that it formed the foundation of future investment. Everyone also knew that debt was a dangerous drug that was only to be used in small doses.

But Keynes challenged the intellectual orthodoxy of his day. He argued that a gold standard shackled the hands of policy makers. For Keynes, an elastic currency allowed governments to spend money when the economy was most in need of new, economic energy. Under Keynesianism, deficit spending was the antidote to recession. His ideas informed governments’ response to the great depression, and played a pivotal role in the creation of a new monetary standard at the close of World War II. To this day, many of Keynes’ most radical ideas are still economic orthodoxy.

2Friedrich August von Hayek (1899-1992)

Friedich August von Hayek, often referred to as F.A. Hayek, was the foil to Keynes’ early rise to prominence. This Austrian-born economist who later settled in Britain had a distinguished career. He earned two doctorates, one in law and the other in political science. He was made a member of the Order of the Companions of Honour by Queen Elizabeth II at the urging of Margaret Thatcher, the first person to receive the Hanns Martin Schleyer Prize, a recipient of the U.S. Presidential Medal of Freedom under George Bush, and a winner of the Nobel Prize.

Hayek was especially known for his contribution to our knowledge of changing prices and their ramifications. According to Hayek, changes in prices provide information which then allow individuals to adjust their expenditures. Under his view, changes in price are an essential element in communicating the state of the economy. This provided a powerful argument in defense of free markets, because manipulating markets encouraged consumers and entrepreneurs alike to make poor investment decisions, whereas free markets communicated truths about the actual health of the economy and therefore the future. Hayek, more so than anyone else in the 20th century, kept the Austrian School in mainstream academic discussions of economics. Although now largely underappreciated in left-leaning western nations, he has become the chief economist for nations recovering from communism and looking to move in a free market direction.

Hayek worked with the Cato Institute which ranks highly among The Most Influential Think Tanks

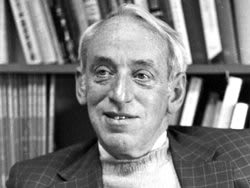

3Milton Friedman (1912-2006)

If the 20th century was the time of central banking and Keynesian economics, then Milton Friedman was the most mainstream alternative. Friedman defended the free market and is considered the leading figure behind the Chicago School of Economics. He received the John Bates Clark Medal honoring economists under the age of 40, and won the 1976 Nobel Prize in Economics.

When Friedman entered economics, Keynesianism dominated the intellectual milieu. But slowly Friedman chipped away at the intellectual orthodoxy. His coauthored volume, Income from Independent Professional Practice, argued that government licensing for doctors artificially raised the price of medicine. A Theory of the Consumption Function, argued that the Keynesian view that households adjust their consumption based on their actual income, as opposed to projected income, was false. In Capitalism and Freedom, he argued for floating exchange rates, a volunteer army, a negative income tax, education vouchers, a deregulated medical field, and numerous other free market proposals for a general audience. His devastating critique of the Federal Reserve in Monetary History of the United States, 1867-1960 so frustrated the Fed that they commissioned a counter history and stopped making their meetings public. To this day, they still keep their meeting minutes private.

By the time Friedman was finished, his conservative views had become the new orthodoxy. He established a place at the table for free market capitalism, and still has many devout followers and ardent enemies.

Friedman worked with the Cato Institute and the National Bureau of Economic Research which rank highly among The Most Influential Think Tanks

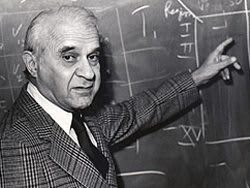

4Lawrence Robert Klein (1920-2013)

Of the various underlying paradigms in economics, which include historical, behavioral, philosophical, and others, Lawrence Robert Klein is one of the best examples of a mathematical approach to the field. Born in Omaha, Nebraska, this MIT trained economist dedicated his career to developing new macroeconometric computer models. He created this metric for economies of all macroeconomic sizes, ranging from the national, to the regional, to the world. Unlike so many economists who spend half their time telling you why their predictions did not pan out, Klein’s work gained notoriety from a series of early successes. While acquiring his PhD under Paul Samuelson in 1944,Klein made multiple successful predictions concerning the economic context of the world immediately following the Second World War. Despite these successes, Klein still left the United States during the post-war Red Scare under McCarthyism due to his brief time in the communist party. Nevertheless, he did eventually return to America and his successes contributed to his winning the John Bates Clark Medal in 1959 and the Nobel Prize in 1980. These models embody Keynesianism, and are still in use by the Federal Reserve, other major central banks around the world, and the International Monetary Fund.

5Robert Lucas Jr. (1937-Present)

The classics never die! Or at least, they never will as long as smart guys like Robert Lucas Jr. keep resurrecting them. Lucas has pushed back Keynes’ macroeconomics and fought to revive many traditional views. He is now considered one of the leading figures in neo-classical economics. Not surprisingly, he is very skeptical of government intervention. He casts doubt on the Phillips curve, which purports to show that government induced inflation lowers unemployment. Lucas has taught at both Carnegie Mellon University and the University of Chicago. He has spent a great deal of time exploring the theory of rational expectations, which begins with certain assumptions about human behavior attempting to act in sensible ways, which maximize utility and build expectations out from these presuppositions. His work won him the Nobel Prize in 1995. Lucas also produced the novel idea that microeconomic behavior should be seen as foundational to macroeconomic behavior. Before Lucas, the Keynesian school saw these two sub-branches of economics as largely independent, but Lucas saw the larger scale model as reducing to the former. Lucas was also very leery of the dangers of unsystematic monetary policy deceiving market participants into making poor choices. This view obviously emphasizes the dangers of government manipulation of markets, even if well intended. As a whole, Lucas is a prime example of the conservative Chicago School of Economics at work.

6Elinor Ostrom (1933-2012)

Many economists have incorporated prior interest in other fields of study into their analysis of money. Usually this involves math, history, or sociology, but Elinor Ostrom has approached things from a different angle. She has championed New Institutional Economics. Under this approach, one studies the background political context that thereby produces the rules under which commerce operates. For Ostrom, the institutional context is critical in order to understand economics, and often the key to advancing the economic agenda involves reforming the pre-existent institutional structure.

This is not surprising considering Ostrom’s formal training at UCLA was in political science. She later took a professorship at Indiana University where she became the Arthur F. Bentley Professor of Political Science. Both she and her husband started the Workshop in Political Theory and Policy Analysis. In 1999 she won the Johan Skytte Prize in Political Science, the John J. Carty Award from the National Academy of Sciences in 2004, and the James Madison Award by the American Political Science Association in 2005. She served as a lead researcher for the government’s SANREM CRSP program, (an initiative studying natural resource management). In 2009 she became the first woman to win the Nobel Prize in economics.

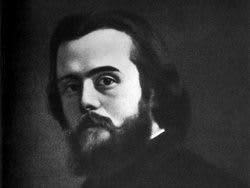

7Leon Walras (1834-1910)

Leon Walras was the son of economist Auguste Walras. This Frenchmen was educated at the University of Paris and became a professor of political economy at the University of Lausanne. He was one of the first figures to use marginal utility, and became the first person to mathematically model general equilibrium in Elements of Pure Economics. This made him an early pioneer in broader, general equilibrium theory. Walras spent substantial energy trying to draw attention to his text, but unfortunately its mathematical sophistication was too intricate to allow the thinkers of his day to adequately appreciate it. Like many great minds, he would not be fully recognized until after his death. He began his models with two parties working in a barter system and then slowly built greater and greater levels of complexity into his system. Despite being largely known for his more theoretical work, Walras was also very interested in practical application. He wanted to improve society with moderately socialist reforms, but passed away before completing a full, systematic treatment on the subject comparable to what he achieved with Elements of Pure Economics.

8Carmen Reinhart (1955-Present)

There are numerous pithy sayings which speak to the circular nature of history. But whether you prefer, “the lesson of history is that we learn nothing from history,” or, “those who don’t study the past are doomed to repeat it,” or even, “those who do study the past are doomed to watch helplessly as everyone else repeats it,” the same overarching point remains. Simply put, people are slow to learn from readily available lessons.

This is why Carmen Reinhart’s book, This Time is Different: Eight centuries of Financial Folly, is as pragmatic a text as one can find for people in power. In it she shows incredible similarity between the boom and bust cycles in history. Her book has been translated into over 20 languages and won the 2010 Paul A. Samuelson TIAA-CREF Institute Award. This, and her numerous other scholarly achievements, is why she now servers as professor of the International Financial System at Harvard’s elite Kennedy School.

Luckily for the rest of us, Reinhart’s work is not merely ivory tower intellectual material that has no substantial impact on the real world. She has served as both the Chief Economist and the Vice President at the Bear Stearns investment bank and worked at the International Monetary Fund. Hopefully her words of wisdom have fallen on open-minded ears.

9James Tobin (1918-2002)

As a Harvard trained academic who later went on to be Yale’s Sterling Professor of Economics, James Tobin was an internationally respected intellectual. He is regarded by many to be the greatest American from the Keynesian School, and eventually won the Nobel Prize for his work in 1981. However, Tobin’s work was more than theoretical. Much of his research was geared towards providing investors with valuable tools so that they could know where to place their money. His pragmatic approach is part of why both during 1955-1961 and 1964-1965 he was the director of the Cowles Foundation for Research in Economics.

Tobin argued that monetary policy is only effective in capital investment. He also noted that although interest rates are a critical factor in understanding capital investment, they are but one of many influences. He is famous for developing “Tobin’s q,” which describes the ratio of market value for an asset to the asset’s replacement cost. Under this model, if a given asset’s q is greater than 1, then the asset should be profitable. He is also well known for what came to be known as, “Tobin’s Tax,” which is a tax on foreign exchange transactions. Tobin saw speculation in foreign currency markets as wasteful at best, and potentially destructive, and consequently encouraged policies which limited this behavior.

10Irving Fisher (1867-1947)

Irving Fisher was one of the most prominent American economists of the early 20th century, and to this day he is arguably the greatest besides Milton Friedman. Like many of his contemporaries, he began his studies in mathematics and later switched to economics. He would eventually receive the first PhD in economics ever offered by Yale. In particular, his Mathematical Investigations in the Theory of Value and Prices, and Appreciation and Interestgained wide acclaim. He spent most of his career at Yale, where he became a member of the Skull and Bones Society and supported various social and political causes aimed at building a utopian world. He advocated for prohibition, world peace, and like many intellectuals of his day, eugenics. He was also a founder and the first president of the Econometric Society.

Fisher was a major figure in the quantity theory. In particular, his theory was the first to utilize both currency and bank credit. He also built on the tradition of Eugen Von Böhm-Bawerk by further developing models of interest. Additionally, Fisher helped advance discussions of utility and general equilibrium.His work inspired the monetarist school of macroeconomic thought. Fisher was also the first celebrity economist, having achieved public intellectual status relatively early in his career. Unfortunately his reputation was forever tarnished when, in 1929, he said the stock market had reached a “permanently high plateau,” shortly before it crashed. Nevertheless, his work on debt deflation has become increasingly influential in recent years as mainstream economists become more and more concerned with deflation.

11Eugen von Böhm-Bawerk (1851-1914)

There are few economists whose ideas are both more relevant and challenged in today’s world of negative interest rates than Eugen von Böhm-Bawerk. This man was born and educated in law in Vienna. His career oscillated between professional occupations, which included three terms as minister of finance, and academic ventures, including professorships at both the University of Vienna and Innsbruck.

Böhm-Bawerk was diametrically opposed to Karl Marx, and alongside Friedrich von Wieser, greatly popularized the Austrian school of economics. His contribution to the field centers on “roundaboutness,” or the concept that physical capital investment both lengthens production and improves productivity. He was one of the first economists to incorporate the passage of time into his theories in a clear and precise way. He noted that people have a time preference. They prefer their desires met sooner rather than later. This time preference is what allows for meaningful interest rates. People will borrow in order to buy today and pay later because they are typically more concerned about the present than the future.

Until very recently, one could make a good argument that Böhm-Bawerk undergirded our entire financial system. After all, the world’s current economic order runs on banking and debt, or stated otherwise, if it were not for the phenomenon that Böhm-Bawerk studied, the modern world as we know it could not exist. However, at the time of this article’s creation, well over 400 million people are living in nations with negative interest rates. Thus, the question poised to current economists is, “was Böhm-Bawerk wrong, or have we utterly perverted the economic order?” And likewise we can also ask, “if he was wrong, then how did we manage to build an entire economy based on debt?” Surely the answer to these questions will remain controversial for some time.

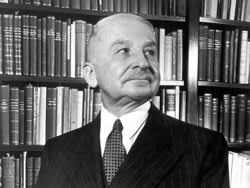

12Ludwig von Mises (1881-1973)

Ludwig von Mises has been called the last knight of liberalism. In many ways, his thought represents the most significant leap forward in the Austrian School. As an Austrian Jew he fled his homeland for the safety of America as the dangers of the Third Reich grew. He was a true genius, having attained fluency in German, Polish, and French, literacy of Latin, and comprehension in Ukrainian by the age of 12.

Mises served as the chief economist for the Austrian Chamber of Commerce before taking a teaching position in Switzerland and eventually fleeing the Nazi advance for New York City. There he became a professor of economics at New York University until his retirement. He spent the majority of his career developing the study of praxeology, or human choice. His magna opus, Human Action, meticulously outlines how individual choices form the bedrock of economics. For Mises, economics is an entirely bottom-up science that extends from the individual. This stands in stark contrast from Marx and various other socialists who think in terms of the aggregate. His work had a major influence on other free market thinkers such as F.A. Hayek and Murray Rothbard. The Mises Institute, one of the world’s foremost think tanks promoting free market capitalism and limited government, promotes both his ideas and those of kindred thinkers.

The Ludwig von Mises Institute ranks highly among The Most Influential Think Tanks

13Alfred Marshall (1842-1924)

Alfred Marshall was one of the most influential economists of his generation. His book, Principles of Economics, was a standard textbook in the field for decades. The text unifies marginal utility, supply and demand, and costs of production under a larger theory. He also contributes to discussions of increasing and decreasing returns in production. Like many economists of the period, he was first trained in mathematics and even served as a professor in that field before later switching to political economics. But despite his extensive mathematics background, his work typically relegates complex equations to footnotes. His work’s consequent readability may have contributed to its influence.

Marshall’s theory revolves around price determination. For Marshall, price results from the relationship between demand and supply and can behave in different ways based on different time periods. In the short term, price is chiefly effected by demand, but in the long term, the cost of production becomes much more significant. At all times, the price is heavily influenced by how competitive the market has become. Marshall was also famous for his scissors analogy, in which he spoke of utility and cost of production as two blades working together as they do in a pair of scissors.

14Joseph Stiglitz (1943-present)

Sometimes an old idea needs a new champion. Keynesian economics, despite having achieved the status of intellectual orthodoxy in the first half of the 20th century and still retaining it, has come under fire numerous times from New Classical Economics. Consequently, proponents of Keynes like MIT-trained Joseph Stiglitz have responded by defending the updated versions of the theory.

Stiglitz has done this in numerous ways, but perhaps the most obvious includes his development of a new branch of economics called “The Economics of Information.” This field studies information asymmetries and develops novel ideas like adverse selection and moral hazard. Much of this work led to him receiving the Noble Prize in economics in 2001. Furthermore, he acted as the lead author of the 1995 Report of the Intergovernmental Panel on Climate Change, which received the Noble Peace Prize in 2007. He has been given over 40 honorary doctorates. The New York Times listed him as one of the 100 most influential people in the world. He was chief economist of the World Bank from 1997-2000 before Janet Yellen succeeded him. He now serves on various prestigious boards such as the Acumen Fund and Resources for the Future.

Stiglitz worked with the National Bureau of Economic Research which ranks highly among The Most Influential Think Tanks

15William Forsyth Sharpe (1934-present)

Some economists spend a lot of time talking about hypothetical abstract models, others put their time into championing political causes, and still others put their knowledge to practical applications like making a ton of money. These are the sort of people that corporations, not-for-profits, and other big money people go to for advice. People like William Forsyth Sharpe are the pragmatically-driven sort who build ideas in order to fill bank accounts.

Sharpe received his PhD in economics from the University of California, Los Angeles. He won the Nobel Prize in 1990. Early in his career he met economist Harry Markowitz during his tenure at the RAND Corporation. Markowitz had a profound impact on his thinking.Later, his work became influential enough to establish financial economics as its own branch of study. He developed a model to explain how securities prices reflect risks and returns. He taught first at the University of Washington in Seattle and later at Stanford University until he left academia in order to start an investment consulting firm. He created the Sharpe ratio, which measures risk-adjusted investment performance. He also played a role in creating the binomial method for options analysis, the gradient method to help determine ideal assets to invest in, and returns-based style analysis for investigating investment fund track records.

16Christopher Antoniou Pissarides (1948-present)

Christopher Antoniou Pissarides was born in Cyprus but has since moved to Britain and done most of his professional work there. He won the Nobel Prize in 2010 for his research on markets with search frictions. He earned his PhD from the London School of Economics in 1973 in mathematical economics, and was elected to the prestigious British Academy in 2002. Since 2009 he has also been a part of the executive committee of the European Economic Association, and a fellow in numerous other academic societies. In 2013 he was even knighted. Pissarides has been a professor at the London School of Economics since 1976, has become the Regius professor there, and is now the Chair for the Centre for Macroeconomics.

Pissarides is particularly known for his work in the search and matching theory underlying relations between the macroeconomy and the labor market. He provided the empirical evidence necessary to model this relationship using the matching function, which shows how labor market changes from unemployment to employment occur in time. In addition to this mathematical modeling, his additional studies include work on structural change and expanding economies. Pissarides’ work is now standard material for graduate students in economics the world over.

17Arthur Laffer (1940-Present)

Did you ever wish you could have your cake and eat it too? Well, according to Arthur Laffer the government can do exactly that. He argued for this by developing the famous “Laffer Curve,” which showed that although raising taxes will initially raise government revenue, doing so beyond a certain point so stymies the economy that it actually does more harm. In other words, if a government raises taxes too much, it will slow economic activity and in the process decrease tax revenue. If one follows this argument to its logical conclusion, then one should be able to lower taxes in such a way so as to increase economic activity and consequently offset the loss in revenue.

The practicality of the Laffer Curve has been criticized by some and praised by others, but love it or hate it, Laffer’s ideas provided the grounding for Reaganomics. Laffer gave Reagan the intellectual justification the president needed to both increase military spending and cut taxes. In addition to this work, he also taught at the University of Chicago, the University of Southern California, and Pepperdine University. Furthermore, he worked as a consultant to the U.S. Treasury and Defense Departments. He eventually became the founder and CEO of a consulting firm in Nashville, Tennessee called Laffer Associates.

18Daniel Kahneman (1934-Present)

If the first half of the 20th century economics represented the rise of the Keynesianism school and the decline of the classical gold standard, and if the second half represented the Chicago School’s free market challenge, then the early 20th century represents the rise of anthropology-based economics that focus on the frailties of human thinking. Daniel Kahneman is a University of Jerusalem and Berkeley trained Israeli-American psychologist and behavioral economist. As is typical with his school of thought, Kahneman draws heavily on the social sciences to understand game theory and decision making. His work establishes a cognitive basis for poor human choices based on heuristics and biases through a series of groundbreaking articles on judgement and decision making.This work eventually came together in a full-blown model called Prospect Theory.

Kahneman’s work was given the Nobel Prize in 2002. He was included in a list of leading international thinkers by Foreign Policy magazine in 2011. He has worked at Princeton since 1993, and is now professor emeritus of psychology and public affairs at the Woodrow Wilson School of Public Policy. He was one of the founders of TGG, a respected business and charity consulting firm.

19Vilfredo Pareto (1848-1923)

In a bygone era the ideal scholar was a generalist renaissance man who knew much about a lot, while in the present era specialist scholars strive to know everything about a little. Vilfredo Pareto was one of the last polyglots who, among his contributions to economics, also worked in philosophy, sociology, and engineering. This Italian economist developed the 80/20 rule, which broadly speaking, states that 80 percent of the effect comes from 20 percent of the causes after he noticed that 80 percent of Italian land was owned by 20 percent of the population. This pattern is common in nature but Pareto found it prevalent in various forms of wealth distribution. He believed that every major civilization’s wealth distribution looked more like an arrow head than a pyramid. There was no gradual distribution of wealth, but a natural division along the 80/20 distinction between the wealthy and the masses. This was true of all peoples across all of history. He was also the first person to popularize the term, “elite,” when referring to a class of people. Pareto was instrumental in transforming economics from a subcategory of moral philosophy as it was practiced during the enlightenment into a mathematically-driven social science. His views were also popular among Darwinists and Mussolini’s fascists supporters, and thus had tremendous historical as well as economic impact, (although Pareto’s personal views of fascism are a matter of more nuanced debate).

20John Bates Clark (1847-1938)

Very rarely do scholars reverse an opinion that they have directed considerable energy towards defending, but John Bates Clark did exactly that with respect to his views about just wages. Earlier in his career he wrote Philosophy of Wealth, Economic Principles Newly Formulated, which attacked competition as a viable form of just wage discovery. Although simultaneously being critical of the communists, Clark nevertheless felt that intervention was required to prevent unfair underpayment of workers, and even compared such practices to indirect cannibalism. However, shortly after publishing this work he began reversing his opinion, and eventually published The Distribution of Wealth, which defended a neo-classical view of economics. Clark used Darwinism to justify a competition-based economics model that allowed the better equipped to advance. Although elements of this process may have appeared savage, the final outcome was superior. Clark also had a unique understanding of capital. For Clark, capital was not the means of production, but rather it was more of a productive tool. This alternative view led to the Cambridge capital controversy between Cambridge University and MIT between 1954 and 1965.

21Ronald Coase (1910-2013)

Ronald Coase spent much of his extensive life span teaching at the University of Chicago Law School. He is particularly known for two influential essays he wrote: the 1937 article titled, “The Nature of the Firm,” and the 1960 article titled, “The Problem of Social Cost.” In “The Nature of the Firm,” Coase asked why the economy organizes into firms. After all, one can imagine an economy where everyone acts as an independent contractor and hires out their respective services on a case by case basis, but instead people organize into larger firms with steady employees. Coase noted numerous advantages that the firm model possessed, from protecting trade secrets to greater efficiency when minimizing overhead costs. This essay was initially criticized by professors from the University of Chicago, but his successful defense of the paper won over his critics and eventually won him a teaching position at Chicago, which in many ways cemented that school’s paradigm shift towards a more free market stance. In “The Problem of Social Cost,” Coase argued that property rights should be distributed in such a way so as to encourage the owner of the property to take economically efficient actions. Coase was trained as an economist, but spent most of his career working in a law school. He was a pioneering figure in the field of law and economics. He won the Nobel Prize in 1991.

22Paul Samuelson (1915-2009)

The New York Timesconsidered Paul Samuelson to be the foremost academic economist of the 20th century. He was the first American to win the Noble Prize in economics in 1970. He was awarded the National Medal of Science, America’s top science award, by Bill Clinton in 1996. He served as an advisor to both Presidents Kennedy and Johnson, and acted as a consultant to the United States Treasury. But perhaps his greatest impact came by writing Economics: An Introductory Analysis. This textbook has sold over 4 million copies and become the all-time best selling economics textbook. It is in its 19th printing.

Samuelson achieved these numerous accolades by developing the mathematical methodology now considered foundational to all economics. Before Samuelson several revolutionary thinkers had explored detailed modeling techniques in their effort to advance their science. However, Samuelson gave such a systematic treatment of the material that his approach soon became the yardstick by which all other economists measured. But despite his great technical accomplishments, Samuelson also popularized his ideas. He brought Keynesianism from esoteric to common sense through his textbook writing and his weekly Newsweek column in which he and Milton Friedman represented opposing views. Because of Samuelson, Neo-Keynesianism became the established academic norm, and continues to exert considerable influence to this day.

23Murray Rothbard (1926-1995)

When most people think of anarchists they think of muscle-bound Rambo-like men with a spear in one hand, an assault rifle in the other, and a massive, freshly slain game animal slung over the warrior’s broad shoulders. How ironic that the most important figure in the anarcho-capitalist movement was really a short, jolly, intellectual? But that is exactly who Murray Rothbard was.

Rothbard’s thinking stands in total contrast to just about everything that modern economics teaches. He argued that government itself was totally unnecessary, and that the free market could do a better job of providing everything that government provides, whether that be roads, healthcare, security forces, or a public justice system. To put things mildly, Chicago School thinkers like Milton Friedman look like socialists by comparison. Even his way of writing is drastically different from the majority of economists. Most modern economists make ample use of math-based models in an effort to model physics. Their texts are drenched in complex, statistically sophisticated analysis. But Rothbard proceeds from very basic propositions and builds axiom upon axiom until 1,500 pages later, a full blown alternative worldview majestically unfolds. His material, being both exhaustive and accessible to the average person, has procured a cult following amongst heterodox thinkers and continues to grow in prominence through the Mises Institute, which he helped found.

Rothbard worked with the Ludwig von Mises Institute which ranks highly among The Most Influential Think Tanks

24Francis Ysidro Edgeworth (1845-1926)

Francis Ysidro Edgeworth was born in Ireland and studied at Trinity College and Oxford. He was one of the last polyglots who could readily excel in multiple academic disciplines. He practiced law, taught literature and logic in addition to political economy, and did pioneering work in mathematical statistics. In 1891 he became the Drummond Professor of Political Economy at Oxford, where he also worked as editor of the Economic Journal.

Edgeworth developed several novel arguments in economics that proved to be fruitful for generations. He produced unique mathematical models that mapped both utilitarian and economic principles. He also was the first person to use indifference curves. These ideas advanced modern general equilibrium theory. Contemporary students of microeconomics will also recognize his Edgeworth Box, which represents various distributions of resources.

But perhaps Edgeworth’s most substantial achievements come from something far more subtle. Before Edgeworth, economics more closely resembled history or philosophy. It usually expressed itself through many words. But Edgeworth’s important mathematical contributions to the field were part of a self-conscious effort to bring economics in line with the more prestigious natural sciences like physics, (hence the name of his famous text Mathematical Psychics: An Essay on the Application of Mathematics to the Moral Sciences). Today, mathematically nuanced models dominate economics, which is in no small part due to the efforts of men like Edgeworth.

25Jeffrey Sachs (1954-present)

There are some scholars who are known for a famous article they wrote, or a magisterial dissertation that changed the way experts understand their field and has since been read by every graduate student. Then there are finance experts who work in banking and Wall Street and get a big break with the government. But Jeffery Sachs became one of the leading scholars on economic development, poverty, and globalism by spearheading a long list of important research initiatives. He is well known amongst numerous influential organizations that make the political world go round.

Sachs was a co-recipient of the 2015 Blue Planet Prize. His fight for the environment has led Time Magazine to twice list him among the world’s 100 most influential leaders. He was the head of the Earth Institute from 2002 to 2016, and he became a professor at Columbia University in 2016. There he acts as Quetelet Professor of Sustainable Development and Professor of Health Policy and Management. He is also the Special Advisor to the U.N. Secretary-General Ban Ki-moon on Sustainable Development issues. In the past he served as a U.N. Secretary advisor on Millennium Development Goals. Sachs is a Distinguished Fellow of the International Institute of Applied Systems Analysis in Luxembourg, director of the Center for Sustainable Development, and director for the U.N. Sustainable Development Solutions Network. He is co-founder and Chief Strategist of the Millennium Promise Alliance, and director of the Millennium Villages Project.

26Carl Menger (1840-1921)

Carl Menger was born and raised in Poland, where he eventually received a law degree from the University of Krakow in 1867. His love of economics developed while working for Vienna’s Prime Minister. He eventually published Principles of Economics in 1871. He spent three years working as the tutor to the Crown Prince of Austria, and eventually became a professor at the University of Vienna from 1873-1903. After that, he retired and spent the rest of his life researching and further building on the arguments he laid down in Principles of Economics, although he never completed another systematic treatment of the material.

Menger used the concept of utility to develop his theory of value and price, (it should be noted that utility for Menger meant subjectively held preferences as opposed to pleasure attainment and pain avoidance). Menger also wrote extensively about the distinction and complimentary relationship between consumer, or lower order, and producer, or higher order, goods. He favored using pure theory over the more empirical and historical case study approach of his German counterparts. His works on monetary theory provided the foundation for what would eventually be called the Austrian School of Economics, and had a particularly profound impact on Ludwig von Mises.

Menger’s work provides the cornerstone for much of the 20th century’s free market thinking. He highly valued institutions that organically developed, as opposed to favoring those which came into existence via top-down central planning, as well as recognized how difficult it is to quantify the sum total of every individual’s subjective preferences.

27John R. Commons (1862-1945)

For many people economics seems like a dry subject that only those with a love of words surpassed by their love of numbers could ever enjoy. But some people are drawn to the field not so much because of ability or curiosity, but rather because of conviction. John R. Commons was such a man, the kind of person on a mission. He was raised in a deeply pious home, and consequently spent a great deal of time trying to gel his Christian convictions with his studies in economics. This led him to a progressive perspective and the institutionalist school of thought, where he systemically defended social change that he thought would bring about a better world.Despite being shunned early in life as a radical, he eventually became a professor at the University of Wisconsin-Madison. Commons made substantial contributions to our understanding of the history of economics. He was the first historian and theoretician of the American labor movement. His defense of the labor union as an institutional vehicle helped establish him as the leader of Wisconsin Institutionalism. He went on to develop an entire theory of institutional economics, which sought recognition of aggregate bodies like labor unions as protecting and bearing the same sorts of rights traditionally ascribed to individuals under classical economics.

28James M. Buchanan (1919-2013)

Economics, like all sciences, originally began as a field of philosophy. It then developed into political economy, which was a combination of what we now call political science and economics. Today most scholars in either field see their work as intimately related, but still separate. James M. Buchanan, however, was chiefly a contemporary political economist who gelled two fields that by his day had separated. He made numerous important contributions, such as his distinction between politics (the rules governing the social game), and policy (the strategies employed within the social game). He developed constitutional economics, which saw the rules governing politics as an essential foundation to all economic activity. He is known for his work on public choice theory, and especially his writings on how politicians’ non-overtly economic decisions are still driven by economic concepts of self-interest. He discovered Austrian economics after independently coming to many of the same opinions held by Mises and realizing his affinity for the latter man’s book Human Action. Buchanan spent most of his career teaching at George Mason University and won the Nobel Prize in 1986.

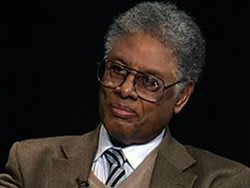

29Thomas Sowell (1930-Present)

Thomas Sowell is a living testament to the fact that early failures do not bar later success. As a young man Sowell dropped out of high school. Nevertheless, he joined the United States Marines during the Korean War, and would later receive a magna cum laude bachelor’s degree from Harvard, a master’s degree from Columbia, and a PhD in Economics from the University of Chicago.

He is now one of the most influential libertarian thinkers in America. He is known for advocating supply-side economics and free market capitalism. Sowell is also a staunch critic of the Federal Reserve, often arguing that since its inception the dollar has suffered systematic inflation and thus the Fed has failed to maintain price stability. He also believes that the Fed has failed to prevent depressions.

Sowell’s work as an economist, political philosopher, and social theorist has led to his writing of over 30 books. It has also granted him a position as a Senior Fellow at the Hoover Institution at Stanford University, a leading think tank with international reputation. He is both a popular syndicated columnist and an academic economist with a regular column distributed by Creators Syndicate. He has won the National Humanities Medal.

Thomas Sowell mentioned among the 10 Most Controversial College Professors

Sowell worked with the Hoover Institute which ranks highly among The Most Influential Think Tanks

30Ernst Fehr (1956-Present)

Some economists have tried to use mathematical models to understand their field, while others have built logical systems precept by precept. Still others see economics as an extension of history. And yet, there is still more room for future economic development. Ernst Fehr is one of the figures building an entirely new approach to the field, which he calls behavioral economics. His research draws much more heavily from evolutionary anthropology than most other economists. He is especially interested in the evolution of altruism and other group dynamics. This research asks questions about the origins and perpetuation of social norms, and the proliferation of social preferences.

Fehr’s research has earned him many accolades. He has held a professorship of Microeconomics and Experimental Economics at the University of Zurich, and is currently the director of the economics department. He previously served as president of the Economic Science Association and the European Economic Association. He is also an honorary member of the American Academy of Arts and Sciences, as well as a John Kenneth Galbraith Fellow of the American Academy of Political and Social Sciences. He won the Marcel Benoist Prize in 2008. He is widely regarded as one of the most influential economists in the German speaking world.

But there is something far more important behind Fehr’s work than a long list of titles. Fehr has given economists an entire new avenue by which they can approach their work. He is drawing from the intersection of biology and sociology in a way that unites the social and hard sciences. Consequently, his research has the potential to dramatically impact the conceptual foundations of economics for generations to come in a way that few scholars ever will.

31Hernando de Soto (1941-Present)

Let’s be honest. Most people think of a crusty old white guy living a pampered life in the Western ivy tower when they hear the word, “economist.” Very rarely do we think of someone whose ideas so radically challenge his context that people try to assassinate him for his work, let alone an individual who is so determined that such mortal danger only makes him work harder. Luckily for the free market of ideas, there are men like Hernando de Soto.

De Soto is an immensely talented man. By the time he turned 38, he had already left his native Peru and established a successful career in business in Europe. But instead of living a life of luxury after earning enough money to retire at such a young age, he instead returned to his people in order to seek economic reform and answer the fundamental question of economics, namely, why are some people poor and others rich. He created the Institute for Liberty and Democracy, a pro-entrepreneurial think tank which promoted free market reform throughout the nation. His institute brought numerous economic reforms, including granting land titles to 1.2 million families and helping 380,000 firms to move from the black market to the open market. Under de Soto’s view, any nation looking to build a strong market economy must also have a working information structure that transitions financial transactions from under the table to cataloged, legal knowledge.

As a result of this public defense of capitalism, the Peruvian Marxist terror organization Shining Path targeted him for assassination. Thus far, their efforts have failed. Instead, de Soto has been honored for his efforts by numerous prestigious groups. Time Magazine called him one of the five leading Latin American innovators of the century, and he now serves as an honorary co-chair for the World Justice Project. Regardless of whether one agrees with or opposes de Soto, no one should deny that his work has had substantial impact on his people, and that he has spent his life systematically attempting to leave the world in a better place than which he found it.De Soto is also featured in our article “50 People Who Deserve a Nobel Prize.”

32Barbara Bergmann (1927-2015)

Barbara Bergmann was in many ways the leading voice for feminist economics of her generation. As someone who grew up in the midst of the great depression, she developed a deeply convicted belief that the government has a moral obligation to help the downtrodden. She carried these convictions with her through her schooling, and eventually graduated from Harvard in 1959. She became further interested in issues of social justice when she read Gunnar Myrdal’s book (who himself won the Nobel Prize with Friedrich Hayek and spent ample time championing social justice in Swedish politics), An American Dilemma, which spoke of racial inequality in the workplace. She authored and coauthored several important books, including The Economic Emergence of Women. She served as a staff economist for the White House Council of Economic Advisers during the 60’s, cofounded the International Association for Feminist Economics, and received the American Economic Association’s Carolyn Shaw Bell Award in 2004 for improving women’s position in economics. In addition to her work arguing that discrimination is manifest throughout labor markets, Bergmann also challenged typical economic metrics which drew conclusions from overly simplistic assumptions. Bergman held that many bad things came from capitalism, but also believed these disadvantages could be controlled, and that the system also produced much good. Unfortunately, after a lifetime of academic success, Bergmann met with an unfortunate end when she committed suicide in 2015.

33Hyman Minsky (1919-1996)

Hyman Minsky studied at the University of Chicago before acquiring his PhD from Harvard in 1954. He later taught at several prestigious schools such as Carnegie Mellon, Brown, and Berkeley, before settling at Washington University in St. Louis. Minsky considered himself a Keynesian with a heterodox interpretation of the famous economic forefather, but many now consider Minsky to be post-Keynesian. He opposed the efficient market hypothesis and instead advanced the financial instability hypothesis. He articulated the notion that when investors have to sell their non-speculative positions in order to pay their debts, the economy unwinds under the weight of deflationary pressure. This has come to be known as the “Minsky moment.” It represents an economic Rubicon from which the financial system cannot turn back without extreme difficulty. This and other pieces represent his opposition to the neoclassical synthesis interpretation of Keynes.

Minsky was a Levy Institute distinguished scholar and created two of their permanent research programs, one being on monetary policy and the other on the state of U.S. and world economics. He was awarded the 1996 Veblen-Commons Award. For a great deal of time Minsky’s ideas were ignored. However, the subprime mortgage crisis of 2008 has created new interest in his work on deflationary debt crashes. Thus, he has become like many great geniuses in that too few recognized his brilliance until both after his death and after his warnings were ignored.

34Anna J. Schwartz (1915-2012)

Anna Schwartz worked for the National Bureau of Economic Research and was a former president of the Western Economic Association International. Schwartz’s research spans numerous topics, but her greatest contributions have examined economic history. She is most famous for her work alongside Milton Friedman on their book A Monetary History of the United States, 1867-1960. This project laid a prolonged attack on the Federal Reserve, and systematically made the case that the Fed’s policies are both what created and what sustained the Great Depression. The work garnered extensive acclaim, being called one of the most influential economic texts of the 20th century by the libertarian CATO Institute, and received high praise from more centrist figures like Fed Chairman Ben Bernanke and left-leaning Paul Krugman. Her and Friedman’s work has set much of the monetary policy for contemporary central bank policy in the wake of the 2008 financial crises. After Keynesian policies proved ineffective in stabilizing the economy, monetarists used their research to justify the role of central banks in stabilizing the economy.

35Kenneth Rogoff (1953-Present)

Kenneth Rogoff is one of the most brilliant high school drop outs you could ever hope to meet. Of course, when you leave school because you are a world class chess player who goes on to play the game professionally and eventually become a grand master, you have a credential which is worth more than most degrees.

Given Rogoff’s intensely abstract and mathematically-tuned mind, it is not surprising that he is now a Harvard economics professor, a member of the prestigious Group of 30, and someone who has worked for both the International Monetary Fund and the Federal Reserve. He is best known for two major contributions. The first was his sharp criticism of Carmen Reinhart’s co-authored book, This Time is Different. Rogoff showed computation errors in the text which challenged the author’s thesis that excess debt undermines GDP growth. Reinhart in turn corrected the computation errors, but continues to defend her initial thesis. The second major policy Rogoff is known for is much more recent. In 2016 he published a book titled The Curse of Cash. According to Rogoff, the untraceable nature of physical cash transactions allows for criminal activity, and the world would be a much safer place if America first phased out the $100 bill, and then the $50, and eventually the $20. This argument, although unthinkable a couple decades ago, has become increasingly popular. Recently the European Union, Australia, and especially India have made similar policy decisions.

36Amartya Sen (1933-present)

Some people come to study economics because they are good at math and find the financial realm to be a useful place to apply their skill set. Others are born with a silver spoon in their mouth, and apply their time and effort at the university towards this particular brand of academics. And then there are others who are motivated by personal conviction, who see the world in an unbalanced state and wonder how it got to be that way.

Amartya Sen is the latter sort of man. He witnessed a great famine while growing up in India, and went on to study the causes of famine from a combination of economic and philosophical perspectives. Sen has combined his knowledge of welfare economics and wealth distribution with philosophy’s study of choice and game theory. His work in this field has significantly impacted the United Nations’ Human Development Report, as well as landed him numerous prestigious teaching positions at places like Oxford and Cambridge. He now teaches economics, philosophy, and law at Harvard. He won the Nobel Prize in economics in 1998.

Sen is especially known for his development of “capabilities.” Under his argument, saying a person has a right that cannot be taken from them is extremely shallow. Instead, a society must equip people with everything they need in order to implement that right and make it a live concept. Sen has effectively raised the bar on what a society needs to provide in order to grant its citizens rights, and consequently has transformed the role of the state.

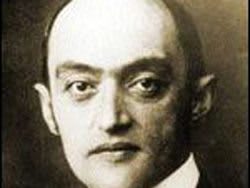

37Joseph Schumpeter (1883-1950)

Modern economic theory tends to be a battle between loose money economic policies from left-leaning Keynesianism and right-leaning free market views. In their most pure forms, this can often involve a pedagogical preference for mathematical modeling by the former school of thought, and system building from the latter. But Joseph Schumpeter represented a third way. He is a prime example of the historical school’s approach to economics. Under this view, it is difficult to build universal laws of economics because unlike physics, economics changes based on its relationship to the culture which produced its context.

Schumpeter, who began his career in Austria but later left under the encroaching forces behind World War II, eventually came to America and finished his career teaching at Harvard. He saw an unfortunate pattern unfolding before him. For Schumpeter, capitalism was a powerful force for good that inevitably had the seeds for its own destruction embedded within itself. In his 1942 book, Capitalism, Socialism, and Democracy, he saw capitalism as leading to increases in wealth, which would then expand the intellectual class and attack the very foundations for the wealth that made their academic positions possible in the first place. Schumpeter popularized phrases in economics, such as “creative destruction,” and further developed our models of entrepreneurship. In 2008 the University of Wuppertal opened the Schumpeter School of Business and Economics.

38Wassily Leontief (1906-1999)

Wassily Leontief was an American economist known for demonstrating the interconnected nature of the economy. He described how changes in one branch of the economy can have both unforeseen and unintended consequences in another area. Early in life his political views brought him into conflict with his native Russian government. After it became obvious his ideological perspectives would never be accepted under communism, he fled to Germany in 1925 where he eventually pursued his PhD, but he later immigrated to the United States. He taught at both Harvard and New York University. His technical achievements include developing the linear activity model of general equilibrium with its input-output analysis, describing the Leontief paradox in international trade, and developing the composite commodity theorem. He won the Noble Prize for showing how inputs for one industry create outputs for another. He also strongly advocated for increasing the use of data intensive mathematical analysis in order to make economics more empirical and less theoretical.

Leontief educated some of recent history’s most prominent economists. He personally advised four doctoral students who themselves won the Nobel Prize, including Paul Samuelson, Robert Solow, Vernon L. Smith, and Thomas Schelling.

39Kenneth Arrow (1921-Present)

Kenneth Arrow earned his PhD from Columbia before moving on to teach at Harvard and then Stanford. His academic career has in large part involved unpacking the ideas embedded in his dissertation. In this work he proves the impossibility theorem, which shows the limitations underlying predicting people’s preferences between options. His groundbreaking work in these fields as well as broader topics in general equilibrium theory and welfare theory led to him acquiring the Noble Prize in 1972.

Arrow was also the first economist to map how learning curves affect entrepreneurial efficiency. It seems intuitive to say that producers will learn more about how to produce their product as they do so, and will, with the passing of time, do so with ever greater efficiency.Nevertheless, Arrow was the first to prove this phenomenon. His successes have made him a leading figure in post-World War II neo-classical economics. In addition to his contributions to more typical areas of economic study, he also studied developing areas of the field such as endogenous growth theory and the economics of information. He is a member of the American Academy of Arts and Sciences and won the 2004 National Medal of Science. Arrow was given an honorary doctorate from Uppsala University in Sweden, and is also one of the few foreign members of the Royal Society.

40Gary Becker (1930-2014)

Some may roll their eyes at those who acknowledge that something works in practice, but still ponder how to make it work in theory. Yet, the dominion of knowledge often broadens the boundaries of knowledge into the unexpected by first securing the cornerstones of common sense. Gary Becker was both an economist and sociologist at the University of Chicago who systematically explained much intuitive phenomenon in an academically rigorous way.

Becker incorporated his knowledge of the social sciences into his understanding of economics in numerous ways. He expanded our conception of what kinds of behaviors count as rational and/or utility maximizing. For instance, he challenged the long held Marxist belief that an individual benefits himself via discrimination, he emphasized the central role self-interest plays in economic decision making, and he recast education as a type of investment. He also studied human capital, altruistic behavior, and the rotten kid theorem. He received the Nobel Prize in 1992, the Presidential Medal of Freedom in 2007, and the John Bates Clark Award of the American Economic Association in 1967. He served as president of the same association in 1987. He also helped found an entrepreneurial and charitable consulting company called the TGG Group.

41Mark Skousen (1947-Present)

Mark Skousen was one of those guys that must have made a lot of his classmates extremely jealous. When he graduated from Brigham Young University in 1972 with a master’s in economics, he already had a fully paid new car, a fiancée, and a job working for the CIA as an economist. He stayed with the CIA for three years before leaving to edit the Inflation Survival Letterand earn a PhD in economics from George Washington University. In 2001, he became president of the Foundation for Economic Education (FEE), the oldest capitalist think tank in America. Skousen developed a yearly conference dedicated to liberty called Freedom Fest. This is the largest annual collection of libertarian-minded thinkers in the world. Grantham University renamed its business school, “The Mark Skousen School of Business” in recognition of his many successes. He was recently named one of the 20 most influential living economists by Super Scholar, and appointed the Presidential Fellow at Chapman University from 2013-2016. He has written 19 books on various academic and economic topics. As his fears concerning inflation and his love of free market capitalism suggest, Skousen is a staunch defender of the Austrian School.

42Wilhelm Röpke (1899-1966)

When looking at the economic juggernaut that Germany became by the latter half of the 20th century and its status as first amongst equals that it acquired under the Eurozone, one would never know that Germany had been devastated by two world wars and the worst hyperinflation of any industrial nation. The intellectual guidance which helped the German people navigate in the wake of such tragedy fell to men like Wilhelm Röpke. He was a major figure in the ordoliberalist movement. This school of thought advocated for free trade, but did so while retaining a greater role for central banking than what their Austrian school counterparts wanted.Nevertheless, he remained critical of intervention laden theories such as Keynesianism. Röpke wanted the competition of the free market, but at the same time also advocated for a state run social security system and a strong government to enforce standards of fairness. His heavy emphasis on human rights led him to increasingly appreciate Catholic social theory and the general benefits of a spiritually inclined culture. To this day Germany still bears many of the hallmark features inherent in Röpke’s ordoliberalism.

43Israel Kirzner (1930-present)

Israel Kirzner studied under Mises at New York University and eventually became a leading authority on his mentor’s work. He would later spend the majority of his teaching career at the same school. Kirzner’s research covers many topics in both theology and economics. The Liberty Fund has set out to publish his complete works, which is a project that spans ten volumes. Furthermore, Israel is also a Rabbi and a leading rabbinic scholar. His most significant economic contributions have studied entrepreneurship. Whereas neoclassical economics stressed perfect competition, Kirzner criticized this perspective in his book Competition and Entrepreneurship on the grounds that it under-emphasized the importance of entrepreneurs. For Kirzner, people compete on a multifaceted level.Competition needs to deal with far more categories than what traditional inputs, outputs, and supply and demand models can provide. Under Kirzner’s view the entrepreneur takes on a leadership role within the larger, free society, and that leadership cannot be easily fit into the older perspectives’ balancing equations. He received the Global Award for Entrepreneurship Studies in 2006 as well as an honorary doctorate from the Universidad Francisco Marroquin. The same university named its Entrepreneurship Center in his honor. He is widely considered the most respected representative of the Austrian school in the post Hayek world.

44Knut Wicksell (1851-1926)

In many ways the modern central banking system is built in the image of Knut Wicksell. Wicksell was a Swedish economist born into a wealthy family, but he lost both his parents by the time he was 15. Inheriting their substantial estate allowed him to dedicate his life to study. At first he focused on physics and mathematics, but his interests would eventually transition into economics. His biggest contribution to the field came from his defense of using interest rates to maintain price stability. What Wicksell argued for at the time was incredibly radical, (remember, the world was still using the simplistic gold standard), but has since become the norm. Every central bank in the world now, whether that be the People’s Bank of China, the Federal Reserve, the European Central Bank, or any number of others, all use interest rates to try and hit their target inflation rates. If it had not been for Wicksell, the justification for letting these institutions exist, let alone dominate the financial markets, would never have formed.

Wicksell was largely a left-leaning social critic. He supported a social welfare state, and was married to the famous feminist Anna Bugge. He spent two months in prison for blasphemy after he wrote a satirical piece criticizing the virgin birth of Jesus. Despite all this, his work also had a substantial impact on the far more conservative Austrian school, which disagreed with his welfare state agenda but drew from many of his ideas about interest rates.

45Thorstein B. Veblen (1857-1929)

Thorstein B. Veblen represented a radical departure from previous social thinkers. Whereas many economists were accustomed to speaking of consumers as rational economic agents constantly making decisions based off the available evidence, Veblen argued that humans are far more based on instinct. Whereas the enlightenment thought of man as logical, and uniquely positioned within the natural world, by Veblen’s day scientists were increasingly seeing humanity as just another part of the animal kingdom. Veblen took substantial training in philosophy and natural history and applied it to economics. Under his view people were as much guided by sociology and embedded anthropological drives as any rational inclinations. His social theory criticized capitalism and became one of the leading voices in the progressive era. He vehemently attacked production for profit, and gave left-leaning thinkers an alternative to Marxism. He saw society as plagued by a handful of individuals who controlled the means of production at the expense of everyone else. Veblen is seen as the founder of institutional economics, a school of thought that emphasizes evolution and the role of institutions in economics. This stood in stark contrast to classical views that much more heavily emphasized the individual.

46Vernon L. Smith (1927-Present)

Vernon L. Smith is most famous for developing the field of experimental economics. His approach to the economic sciences grew out of his early training in electrical engineering (he received his PhD in the field from Caltech in 1949). Afterwards he earned his doctorate in economics from Harvard in 1955. With this scientific training undergirding his background in economics, Smith found a unique solution to a typical problem. He was struggling to explain basic microeconomic theory to his students in a succinct way while teaching a class in Principles of Economics. He decided to design an experiment the next semester that would incorporate the students. He wanted them to take part in a mini, simulated economy where the principles being discussed would guide the students’ behavior. The class project was such a success that Smith began exploring ways to expand this approach. Eventually his colleagues encouraged him to develop his ideas into a full-blown research methodology, which he did over the course of two influential articles.Eventually, Smith’s work developed into a full-fledged sub-field of economics, and won him the Nobel Prize in 2002. Smith has tried to translate his economic expertise into practical, real world change. He has served as an expert for the Copenhagen Consensus, and has been one of the most active economists in open petition aimed at changing government policy.

Smith worked with the Mercatus Center at George Mason University which ranks highly among The Most Influential Think Tanks

47Peter Boettke (1960-present)

Many scholars dream of becoming the center of an intellectual movement, of being recognized as the leader in their respective school of thought. A small number of geniuses achieve this in their old age. And then there are a lucky few like Peter Boettke who accomplish this feat amidst youthful vigor. Boettke is a professor of economics and philosophy at George Mason University, as well as the director of the F.A. Hayek Program for Advanced Study in Philosophy, Politics, and Economics at the Mercatus Center. He has been a visiting scholar at numerous leading institutions such as the Russian Academy of Sciences in Moscow, the Stockholm School of Economics, the Max Planck Institute, and the Central European University in Prague. He was also a Fulbright Fellow at the University of Economics in Prague, Czech Republic. This rapidly rising star with increasingly international appeal has dedicated his time to defending analytical anarchism. This school of thought envisions a radically libertarian economy where individuals and institutions operate without any substantial government influence. The law largely exists to enforce contracts and protect property rights. Under Boettke’s view, this extremely free market position would lead to greater prosperity than a more centralized system.

See our interview with Peter Boettke

Boettke worked with the Mercatus Center at George Mason University which ranks highly among The Most Influential Think Tanks

48Arthur Pigou (1877-1959)

Arthur Pigou was one of the finest examples of a British gentleman scholar. His opposition to violence led him to oppose World War I, but his love for his fellow man and his country also led him to volunteer as an ambulance driver and and go on numerous, dangerous missions. He had many deep criticisms of Keynes, but nevertheless personally funded the man’s work and remained friends with his rival throughout their lives. This is especially impressive considering how often Keynes criticized him in his chief work, The General Theory of Employment, Interest and Money. Pigou was part of the classical school of thought, and he specialized in welfare economics.

Pigou’s most important work is his 1920 book, The Economics of Welfare. This text proposes externality. Under this view, one can correct a social problem by introducing a tax (now called a Pigovian tax). This view has been utilized numerous times to correct excess and social ills. Right now its biggest application is connected to environmentalism, since many would like to implement taxes on behaviors and products that damage the environment, such as the carbon tax. Pigou spent most of his career at Cambridge University when Cambridge was highly regarded as the leading economics institution in the world.

49Nassim Nicholas Taleb (1960-Present)

There are two kinds of people in the world; those who try to fit our chaotic existence into a semblance of order, and those who believe that the best one can do is surf the waves of chaos as reality hurls them at you. The latter group has much to thank Nassim Nicholas Taleb for. Taleb’s famous book, The Black Swan, describes the power of unforeseeable events, and the damage they can wreak on unsuspecting societies. This Lebanese-American writer and statistician thinks of himself as an epistemologist of randomness as opposed to a businessman. His work on probability examines the limitations of knowledge, and likewise proves the importance of anticipating seemingly impossible scenarios.

This extremely skeptical starting point has led Taleb to oppose large scale social theorizing. He has gone so far as to say that the Nobel Prize in economics should be done away with, for the damage that economic metanarratives does is immense. Instead, he advances what he calls “robustification” and “anti-fragility.” Not surprisingly, his PhD dissertation focused on the mathematics of derivatives pricing, which is arguably the most unstable part of the market. Regardless of whether you think Taleb goes too far in his sweeping rebuttal of most economic theorizing, at the very least this very bright man’s words are a much needed call for sobriety in a market otherwise known for excess.

50Paul Robin Krugman (1953-Present)

As a winner of the Nobel Prize and a professor at places like MIT, Princeton, and the Graduate Center of the City of New York, Paul Krugman is a respected thinker and leader in his field. However, his regular column with the New York Times and common television appearances also make him a public intellectual. Part of this public persona is his brilliance, and part of it is his willingness to follow Keynesian logic to its absolute conclusion in a colorful manner. For instance, in a televised interview in 2011 he stated that faking an alien invasion would end the recession in 18 months as the whole world undertook aggressive increases in production in order to fight this imaginary foe. Silly illustrations aside, Krugman’s views represent one of the most articulate defenses of contemporary Keynesianism. He wholeheartedly endorses using government deficit spending to spur slouching economies, and provides one of the most outspoken voices for the left’s political and economic policies.

Krugman’s contributions to economics are numerous, but perhaps his most well-known idea addresses why similar economies are more likely to trade with each other. It is easy to see why two nations that produce vastly different goods would trade because one nation has a great comparative advantage in a particular aspect of trade, but how do we explain the preference for trade amongst economies with similar products?Krugman’s answer says that consumers prefer choice across the same kind of product, and due to the economy of scale it is often cheaper for a region to specialize in the creation of one kind of product, as opposed to replicating a less specialized and more diverse collection of products across many regions. The end result is that a country will often specialize in a small number of products instead of a more jack of all trades approach to production.

Krugman worked with the National Bureau of Economic Research which ranks highly among The Most Influential Think Tank.