Tejvan Pettinger

Definition

Trade diversion occurs when tariff agreements cause imports to shift from low-cost countries to higher cost countries. Trade diversion is considered undesirable because it concentrates production in countries with a higher opportunity cost and lower comparative advantage.

Trade diversion may occur when a country joins a free trade area with a common external tariff.

Example of trade diversion

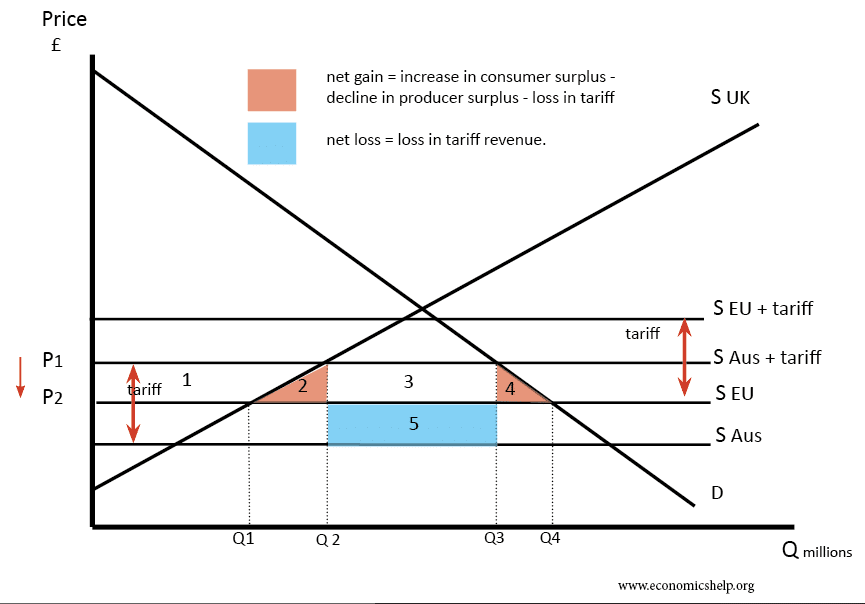

- Suppose the UK place a tariff on the import of cauliflowers to all countries equally. There is an equal tariff to European countries and equal tariff to Australia.

- In this case, the UK will import from Australia at a price of P1. This is the lowest cost country in terms of producing cauliflowers.

- The UK government also gets substantial tariff revenue. It is equal to *S Aus + tariff – S Aus) x Q3-Q2. Or more simply areas 3+5

- Consumers will pay a price of P1, and total quantity of cauliflowers will be Q4

- Domestic producers will sell Q2

Joining customs union

- After joining the customs union, the UK abolishes tariffs with EU, but not Australia. The price of importing cauliflower from the EU falls to P2.

- Consumers gain an increase in consumer surplus of areas 1+2+3+4

- UK producers sell less they only sell Q1, as we now import more Q4-Q1

Net welfare effects to UK

- The government loses tariff area 3+5

- Consumers gain area 1+2+3+4

- Producers lose area 1

- The net gain is (2+4) – 5

- In this case area, 5 is greater than 2+4. So there is a net welfare loss to the UK – even though consumers benefit from lower prices.

- It is possible area 2+4 can be greater than 5 – depending on the elasticity of demand.

Overall welfare effects

- Australian farmers lose out. Exports fall.

- EU farmers gain

- The global economy loses out because we have shifted from low-cost producers – Australia – to relatively high-cost producers the EU.

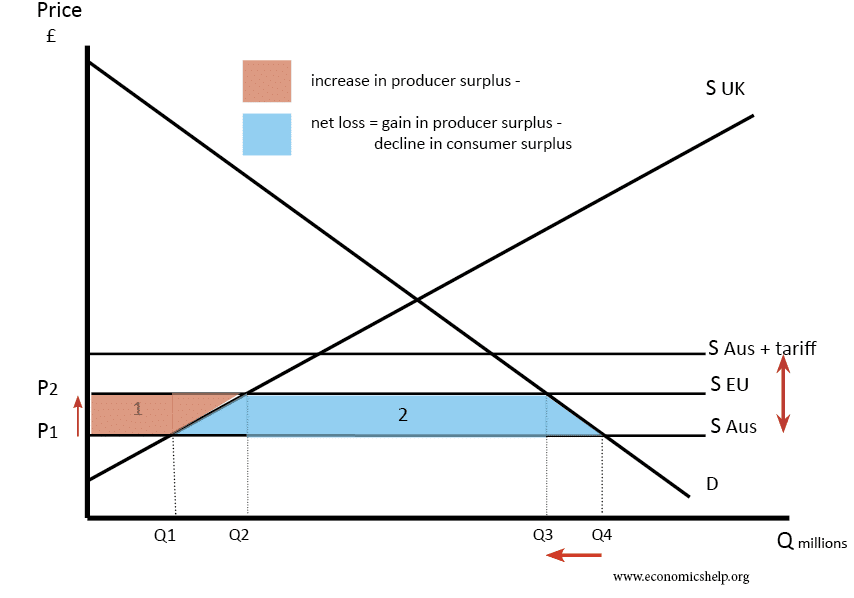

Joining custom unions from a position of free trade

- The above analysis suggests the UK had equal tariffs to all countries, such as Australia. However, before joining the EEC, the UK had free trade agreements with countries in the Commonwealth, such as New Zealand and Australia.

- When the UK joined the EEC, it had to implement an EEC wide common external tariff of imports from outside the EU. The effect was to make Australian and NZ agriculture more expensive than previously. Therefore we switched imports from New Zealand to European countries. Prices rose for consumers for items like butter.

- Consumers tend to lose out because they pay higher prices from the less efficient producer.

- By joining the EEC, the UK gained from new free trade agreements within Europe. The big losers were New Zealand and Australia who lost trade to the UK.

In this case, we used to import from Australia at P1 imports (Q4-Q1). i.e we had free trade with Australia

- After joining EEC, we had to put tariffs on Aus imports (due to common external tariff)

- Price rose from P1 to P2, leading to a decline in consumer surplus of 1+2

- UK producers do gain an increase in producer surplus of area 1

- Net loss to UK is area 2