C. P. Chandrasekhar and Jayati Ghosh

- August 27, 2019

Two years after its implementation, the extent to which the Goods and Services Tax (GST) regime is an improvement upon the earlier system of multiple excise and sales taxes remains unclear. As of now, there are several worrying trends. The first is that gross GST collections are short of expectations. Thus, as against a target of Rs. 1,12,000 crore a month set for 2018-19, average GST revenues fell short of Rs. 1 lakh crore a month in that year. The shortfall is a problem especially for the states, because, while they have given up a significant part of the taxation powers they had earlier, they will be compensated only for five years (using revenues from a special cess) for any shortfall in revenues relative to a projected revenue growth target of 14 per cent per annum.

Second, while month-wise gross GST collections (relative to the corresponding month of the previous year) have been rising almost consistently over time (Chart 1), collections by or due directly to the states have been quite volatile and have not displayed the same consistent rise (Chart 2). That is, the GST revenue accruing to the central divisible pool is doing better than that received by the states from the state GST (SGST) and integrated GST (IGST). This raises concerns about what the revenue position of the states would be three years from now, when the 5-year transition period would come to an end.

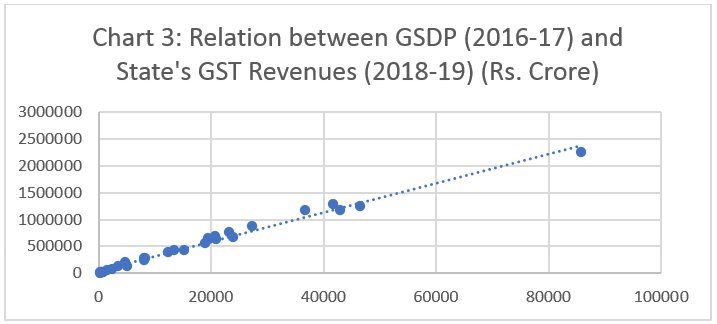

Finally, while many states seem to be losing out as of now relative to the minimum revenue growth targeted after the move to the GST regime, the new structure of indirect taxation seems geared to accentuate inter-state inequalities. Two features of GST revenues of the states stand out. One is the strong positive relationship between the GDP of a state and the volume of revenues garnered through both the state level GST and the concerned state’s share of the integrated GST (IGST) collected by the Centre (Chart 3). This strong positive relationship is surprising because, given the fact that the GST is a destination tax, it was expected to favour ‘consuming states’ as opposed to the richer ‘producing states’, which supply goods and services to consumers in other states besides to their own population. Even the IGST collected by the Centre is shared with the state in which the good or service concerned is sold and not the one in which it was produced. Hence, one should expect the ‘consuming states’ to do better. But the strong positive relationship between Gross State Domestic Product (GSDP) and aggregate GST revenues of individual states indicates that the homogenisation of indirect tax rates imposed on individual commodities across states has also homogenised the ratio of GST revenues to GSDP across states. Richer states in terms of aggregate GDP such as Maharashtra, Uttar Pradesh, Karnataka, Tamil Nadu and Gujarat, also receive the largest GST collections. Maharashtra, which is an outlier in terms of aggregate GSDP, is also an outlier in terms of GST revenues.

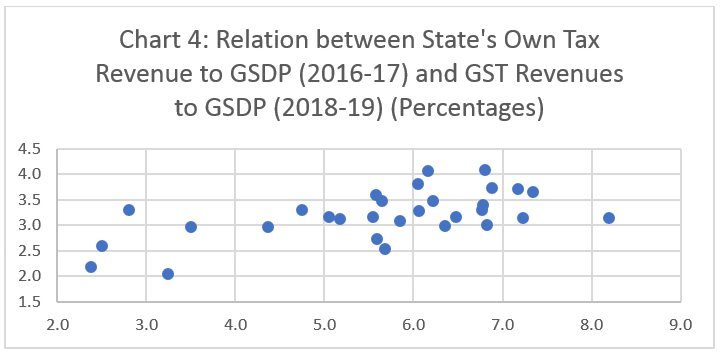

This tendency towards convergence of the ratio of state GST revenues to GSDP is significant because it points to a decline in the variation of the tax to GDP ratio across states. Own tax revenues of the states come overwhelmingly from indirect taxes, as the power to impose direct taxes rests largely with the Centre. With the coming of the GST regime, barring a few exceptions like petroleum products and alcohol, indirect taxes are in substantial measure garnered through taxes subsumed under the GST regime. A comparison of the own tax revenues to GSDP ratios of individual states in 2016-17 (before the implementation of the GST regime) with the ratio of GST revenues to GSDP of the same states in 2018-19 is telling. As Chart 4 shows, there is little relationship between the two ratios across states.

What does this indicate? A measure of the spread of a set of numbers around their mean is their ‘standard deviation’. The standard deviation of the ratios of the own tax revenues to GSDP of the states in 2016-17 was, at 1.5, much higher than the standard deviation of the ratios of GST revenues to GSDP in 2018-19 of 0.5. That is, GST revenues to GDP ratios of different states have converged, relative to the pre-GST own tax revenues to GSDP. Earlier, states like Puducherry, Goa, Himachal Pradesh, J&K, Uttarakhand, Jharkhand, Assam and Chhattisgarh had higher own tax revenues to GSDP ratios than many richer states. However, under the GST regime a state with lower GSDP would also mobilise a lower amount of resources from taxes subsumed under the GST. That is, the degree to which a poorer state can overcome the drag imposed by its level of development (as measured by GSDP) on the revenues garnered through taxation, and therefore on its ability to spend, is likely to be lower in the case of revenues from GST, compared to the earlier taxation regime.

One reason for this difference is that commodities like petroleum and alcohol, which are important sources of revenue for some state governments, have been left out of the GST regime. But the reduced variation is also because of the homogenisation of state level indirect tax rates on individual commodities and the reduction in the number of rates.

This has a larger implication. With the states having given up the flexibility with regard to which commodities they choose to tax and how much to tax them, poorer states have become more dependent on the share of central revenues received by them, as a result of the Finance Commission’s formula, to make up for the drag imposed by their backwardness on spending for development. On the other hand, richer states receive a stronger push in their favour, because of the relatively higher volume of resources they are able to mobilise. This difference would only widen as the GST regime is generalised to cover commodities like petroleum products and alcohol.

In sum, the GST regime not only threatens to deprive states of resources they may have mobilised if it had not been put in place, but it also worsens the relative position of the poorer states relative to their richer counterparts and increases their dependence on resources transferred from the Centre.

(This article was originally published in the Business Line on August 27, 2019)