General strategies

- Profit maximisation. One strategy is to ignore market share and try to work out the price for profit maximisation. In theory, this occurs at a price where MR=MC. In practice, it can be difficult to work this out precisely.

- Sales maximisation. Aiming to maximise sales whilst making normal profit. This involves selling at a price equal to average cost.

- Gaining Market Share. Some firms may have a target to increase market share, this could involve setting prices as low as they can afford, leading to a price war. A similar concept to sales maximisation.

See: Objectives of firms

Pricing strategies to attract customers / increase profit

- Premium pricing. This occurs when a firm makes a good more expensive to try and give the impression that it is better quality, e.g. ‘premium unleaded fuel’, fashion labels.

- Loss Leaders This involves setting a low price on some products to entice customers into the shop where hopefully they will also buy other goods as well. However, it is illegal to sell goods below cost, so firms could be investigated by OFT.

- Price Discrimination. This involves charging a different price to different groups of consumers to take advantage of different elasticities of demand. There are different types of price discrimination from first degree to third degree.

- Reference Pricing. This involves setting an artificially high price to be able to later offer discounts on previously advertised price.

- Price Matching. The purpose behind price matching is making a promise to match any price cuts by your competitors. The argument is that this discourages your competitors from cutting price. This is because they know there is little point in cutting prices because you will respond straight away. Very clear price matching stances can thus avoid price wars and give the impression of being very competitive. For example, Tesco is offering £10 voucher to customers who can prove their shopping basket would have been cheaper at other supermarkets.

- Retail price mechanism RPM – when manufacturers set minimum prices for retailers, e.g. net book agreement.

- Psychological pricing. Setting price at important psychological levels to trigger purchase, e.g. selling good at £9.99 to make it appear cheaper. Some firms use reverse psychology and charge exact prices, e.g. clothes for £40 to indicate quality rather than cheapness.

- Premium decoy pricing. Where a firm sets the price of one good deliberately high to encourage demand for a lower price. e.g. a car company may bring out a top of the range sports car, which is very expensive to make the general brand more attractive.

- Pay what you want. A situation where consumers are left free to decide how much to pay, e.g. restaurants cafe where there is no cost – only tipping. When music companies release a new recording and ask for donations.

- Bundle pricing. When a firm gives special offers, e.g. buy 3 for the price of 2 – very common for book sales e.t.c.

- Price skimming. When a firm releases a new product, it initially sets a high price to take advantage of those consumers with inelastic demand. Over time, the price is reduced to attract those customers with more price elastic demand.

- Penetration pricing. When a firm sets a low price to help establish market share and get established. For example, a new printing company may offer very low price for its printers to get established. Then it gets to make profits on selling ink and over time increase the price. Or satellite tv company offering introductory offer for a few months.

- Optional pricing. When a firm tries to receive a higher price by selling extras. For example, if you buy a DVD, you can get sold insurance or additional features.

- Dynamic pricing. When prices are regularly updated in response to shifting market conditions. For example, if an airline receives high demand for certain flights, it will increase the price to help fill up other departure times and maximise revenue from the flight.

Pricing strategies to cement market share/market position

- Limit pricing. This occurs when a monopoly set price lower than profit maximisation to discourage entry. This enables the firm to make supernormal profit, but the price is still low enough to deter new firms to enter the market.

- Predatory pricing. Selling price below cost to try and force rival out of business. Predatory pricing is illegal. Predatory pricing can be made easier through cross Subsidisation. This occurs when a big multinational may use profits in one area to subsidise a price war in another. The cross subsidisation enables a firm to sell a product very competitively (or even at a loss) to try and force the rival firms out of business.

Pricing strategies to help determine the price

- Average cost pricing. When a firm sets the price equal to average cost plus a certain profit margin.

- Market-based pricing. When firms set a price depending on supply and demand. For example, if football clubs, used market-based pricing, clubs like Manchester United would probably increase the ticket price – because, at the moment, all tickets are sold out – suggesting price is below the equilibrium.

- Markup pricing. This involves setting a price equal to marginal cost of production + x. (where x = the profit margin a firm wants to make on each sale)

- Profit maximisation. Setting price and quantity so MR=MC

Importance of Elasticity

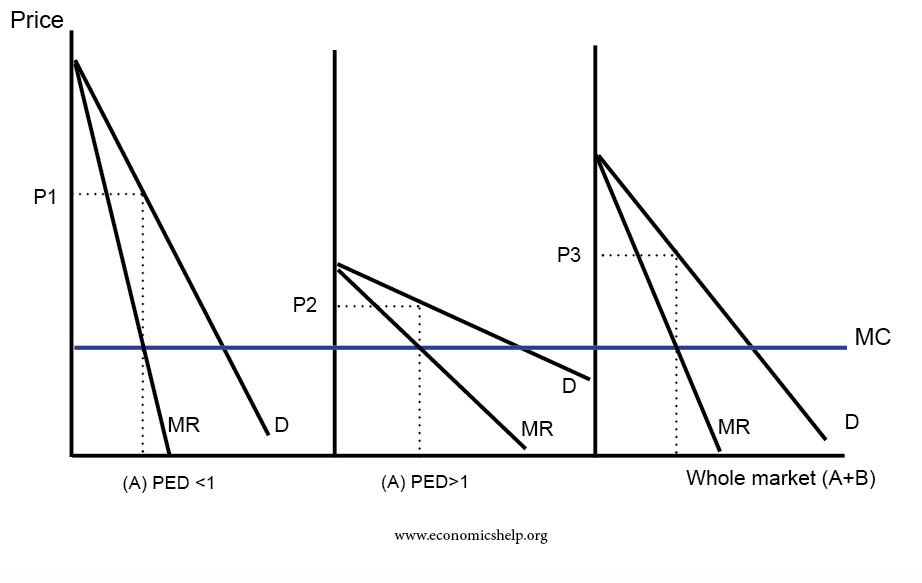

If demand for your products is highly elastic, cutting prices should lead to an increase in revenue. Increasing prices will lead to a fall in revenue.If demand is price inelastic, then you can increase your profits by increasing your price.

This is the logic behind price discrimination. Firms charge a higher price to that market segment where demand is more price inelastic, but a lower price to where demand is more price elastic.

What will determine the most effective pricing strategy?

The optimal pricing strategy will depend on the type of firm. For example, if you are considered to having a premium brand – cutting price could be perceived as disastrous as you lose your brand image, and fail to increase sales. For these products, it might be better to maintain premium pricing and optional pricing. For normal goods, with firms looking to increase market share and gain more market dominance, it is more important to offer competitive prices, through strategies such as penetration pricing and even loss leaders.